Let’s take an updated look at how King County’s sales are shifting between the different regions around the county, since geographic shifts can and do affect the median price.

In order to explore this concept, we break King County down into three regions, based on the NWMLS-defined “areas”:

- low end: South County (areas 100-130 & 300-360)

- mid range: Seattle / North County (areas 140, 380-390, & 700-800)

- high end: Eastside (areas 500-600)

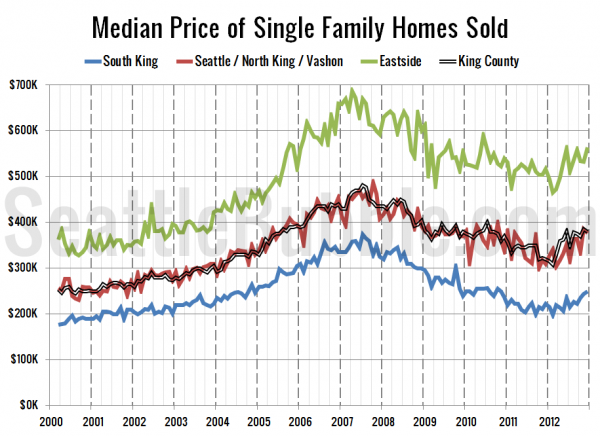

Here’s where each region’s median prices came in as of December data:

- low end: $193,000—$303,475

- mid range: $271,500—$729,000

- high end: $424,953—$1,035,000

First up, let’s have a look at each region’s (approximate) median price (actually the median of the medians for each area within the region).

The mid range dipped a bit in December, but the low and high regions both ticked up again.

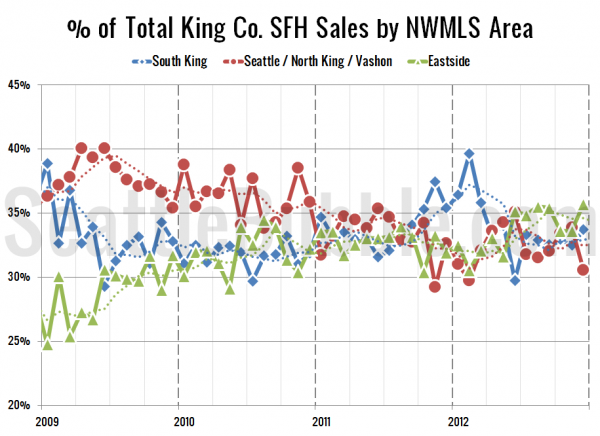

Next up, the percentage of each month’s closed sales that took place in each of the three regions. The dotted line is a four-month rolling average.

Big shift this month as the spendy Eastside spikes up, stealing share from mid-range Seattle. As of December 2012, 33.7% of sales were in the low end regions, 30.6% in the mid range, and 35.7% in the high end. A year ago the low end made up 35.4% of the sales, the mid range was 32.7%, and the high end was 31.9%.

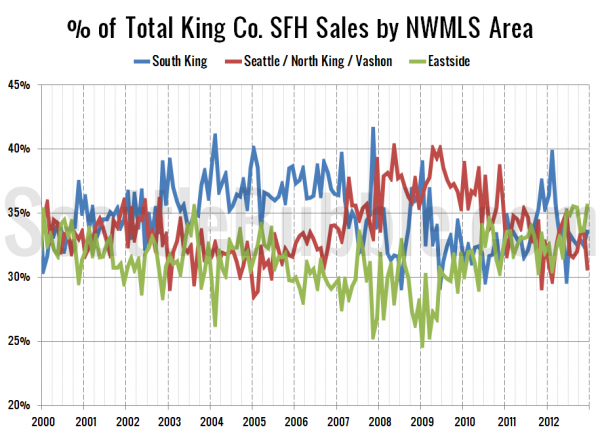

Finally, here’s an updated look at this same set of data all the way back through 2000:

There haven’t been many times when the expensive Eastside regions have had the largest share of sales. We’re certainly in the midst of a weird market.

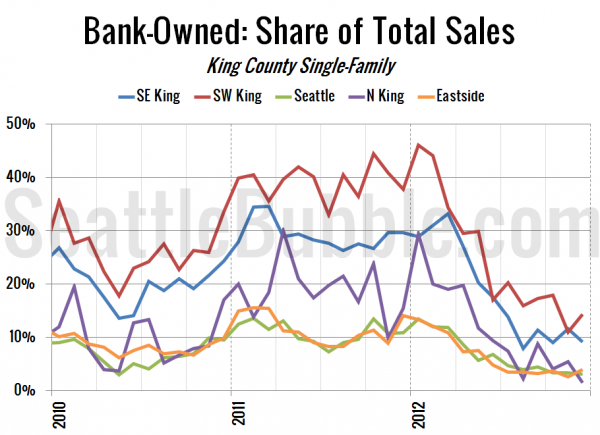

As a bonus, here’s a chart of the share of sales in each NWMLS region that were bank-owned. I created this one for Eric Pryne over at the Seattle Times a few months ago, and have updated it with December data. In this chart I’ve grouped zip codes into their approximate NWMLS regions, which break South County into SE King and SW King and display Seattle an N King separately.

At its peak in January of 2012, nearly half of the sales in SW King County were bank-owned homes, but as of December that number had fallen to just 14%. With the dramatic, across-the-board drop in bank-owned sales combined with the strengthening of sales in the expensive Eastside regions, it’s no wonder the county-wide median price has gone up so much over the past year.