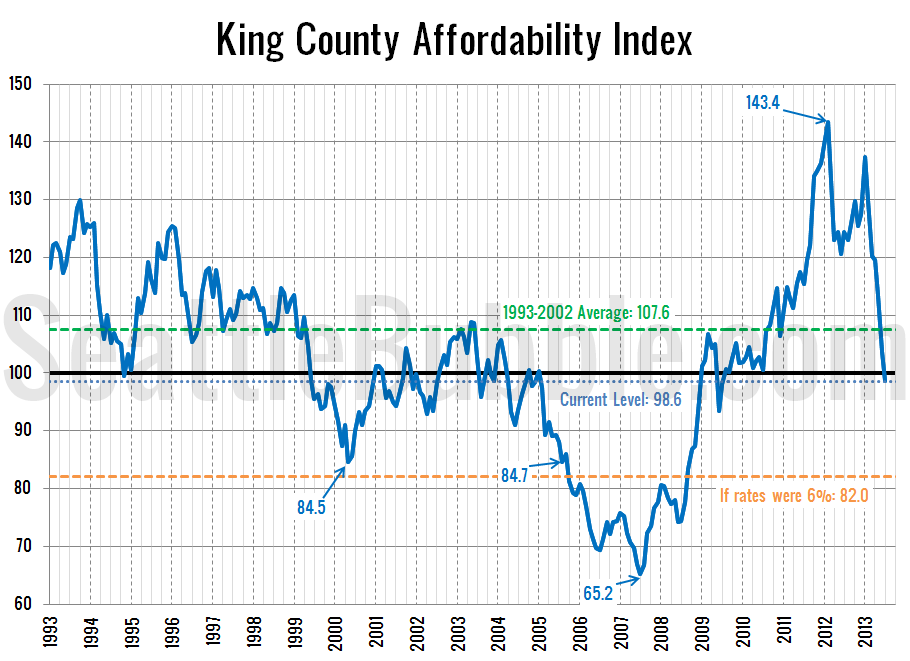

As volatile as interest rates and home prices have both been this year, I thought it would be good to make the affordability index more of a regular post.

So how does affordability look as of July? Not great. The index fell below 100 (i.e. the median-priced home is affordable to a median-income household) for the first time since July 2009.

I’ve marked where affordability would be if interest rates were at a more sane level of 6%. An affordability index of 82.0 is once again below where the index was in August 2005 when I first started Seattle Bubble (rates were 5.82% at the time), but is still quite a bit above the low point in the 60s that the index hit in 2007.

I still expect this rapid deterioration in affordability to put the brakes on the price increases we’ve seen over the last year or so.

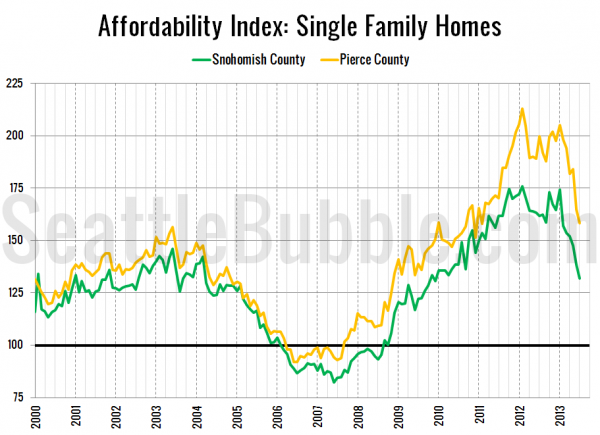

Here’s a look at the index for Snohomish County and Pierce County since 2000:

Snohomish County’s affordability index is at its lowest point in 43 months, while Pierce County’s index is only at a 29-month low.

Next week I’ll post updated versions of my charts of the “affordable” home price and income required to afford the median-priced home. Hit the jump for the affordability index methodology.

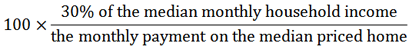

As a reminder, the affordability index is based on three factors: median single-family home price as reported by the NWMLS, 30-year monthly mortgage rates as reported by the Federal Reserve, and estimated median household income as reported by the Washington State Office of Financial Management.

The historic standard for “affordable” housing is that monthly costs do not exceed 30% of one’s income. Therefore, the formula for the affordability index is as follows:

For a more detailed examination of what the affordability index is and what it isn’t, I invite you to read this 2009 post. Or, to calculate your the affordability of your own specific income and home price scenario, check out my Affordability Calculator.