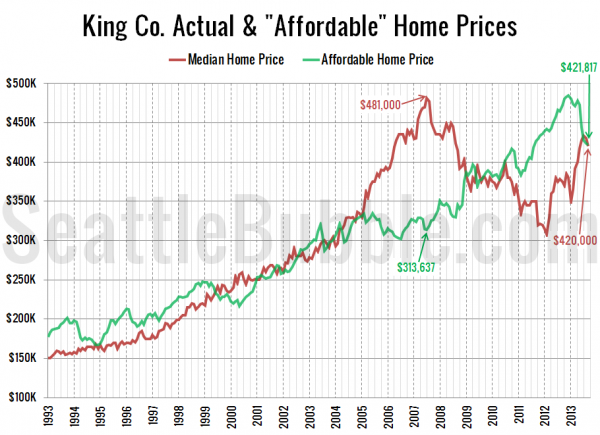

As promised in last night’s affordability post, here’s an updated look at the “affordable home” price chart.

In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could afford to buy at today’s mortgage rates if they put 20% down and spent 30% of their monthly income.

The “affordable” home price fell for the fifth straight month in September, dipping just slightly below the county’s median sale price. The “affordable” home in King County now sits at $421,817, with a monthly payment of $1,708.

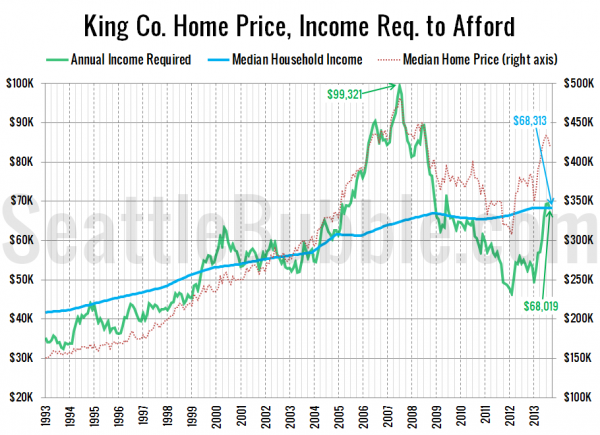

Here’s the alternate view on this data, where I flip the numbers around to calculate the household income required to make the median-priced home affordable at today’s mortgage rates, and compare that to actual median household incomes.

As of September, a household would need to earn $68,019 a year to be able to afford the median-priced $420,000 home in King County (up from the low of $46,450 in February 2012). Meanwhile, the actual median household income is around $68,000.

If interest rates were 6% (around the pre-bust level), the “affordable” home price would drop down to $356,064—15% below the current median price of $420,000, and the income necessary to buy a median-priced home would be $80,580—18% above the current median income.

Back in July I said that “I expect home price increases to come to a grinding halt in the second half of 2013.” So far that appears to be exactly what’s happening.