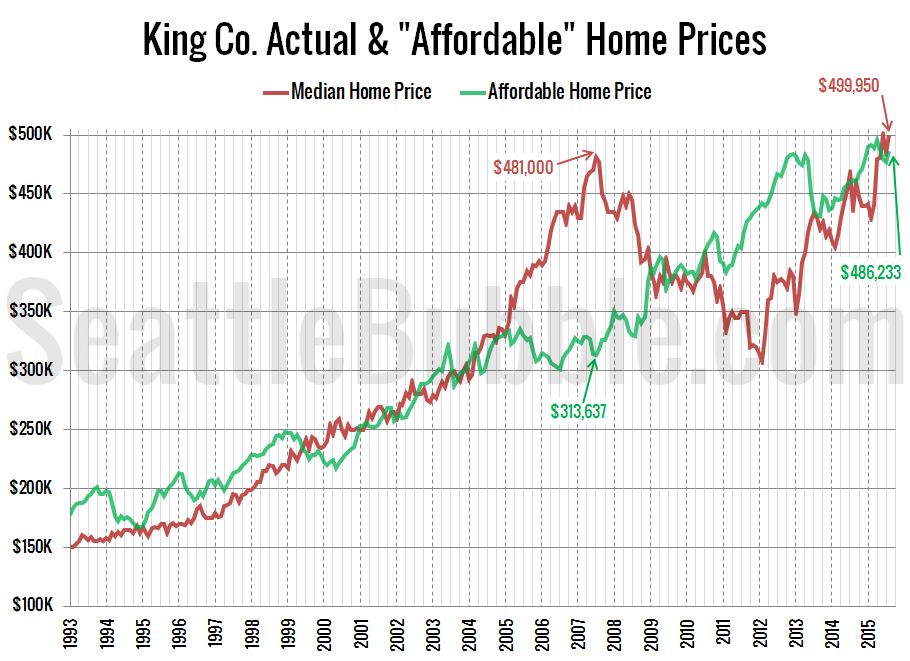

As promised in yesterday’s affordability post, here’s an updated look at the “affordable home” price chart.

In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could afford to buy at today’s mortgage rates if they put 20% down and spent 30% of their monthly income.

The “affordable” home price hit $496,051 back in April, but has since dropped off as interest rates have inched up from 3.67% in April to 3.91% in August. As of last month, the “affordable” home price in King County is at $486,233, with a monthly payment of $1,837.

If interest rates were at a more reasonable level of 6 percent (which is still quite low by historical standards), the “affordable” home price would be just $382,986—about $103,000 lower than it is today.

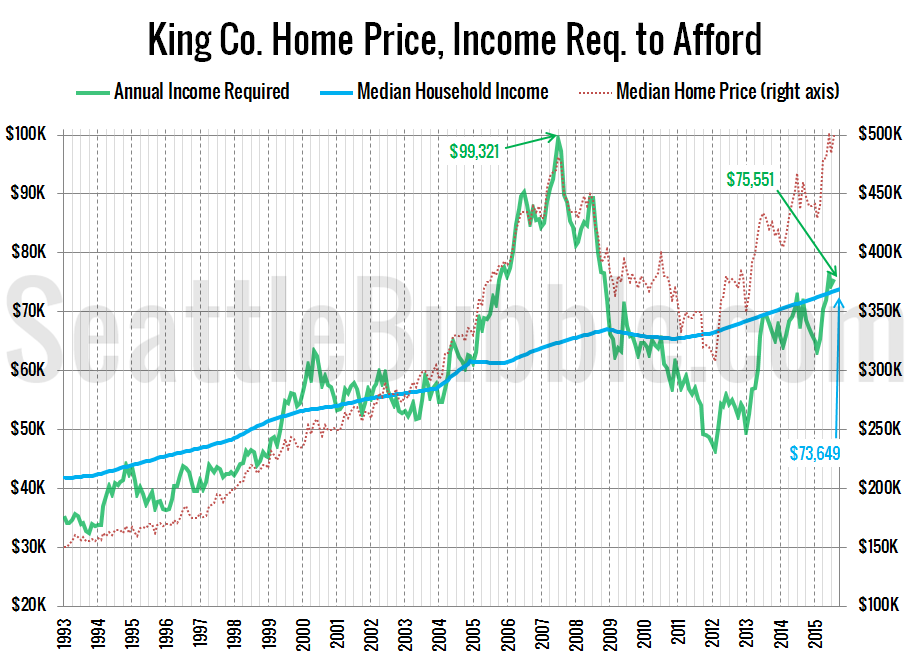

Here’s the alternate view on this data, where I flip the numbers around to calculate the household income required to make the median-priced home affordable at today’s mortgage rates, and compare that to actual median household incomes.

As of August, a household would need to earn $75,551 a year to be able to “afford” the median-priced $499,950 home in King County. This is up from the low of $46,450 in February 2012, and just barely below the recent high of $76,202 set in June. Meanwhile, the actual median household income is around $73,000.

If interest rates were 6% (around the pre-bust level), the income necessary to buy a median-priced home would be $95,918—31 percent above the current median income.

It’s no wonder the Fed is terrified to raise interest rates.