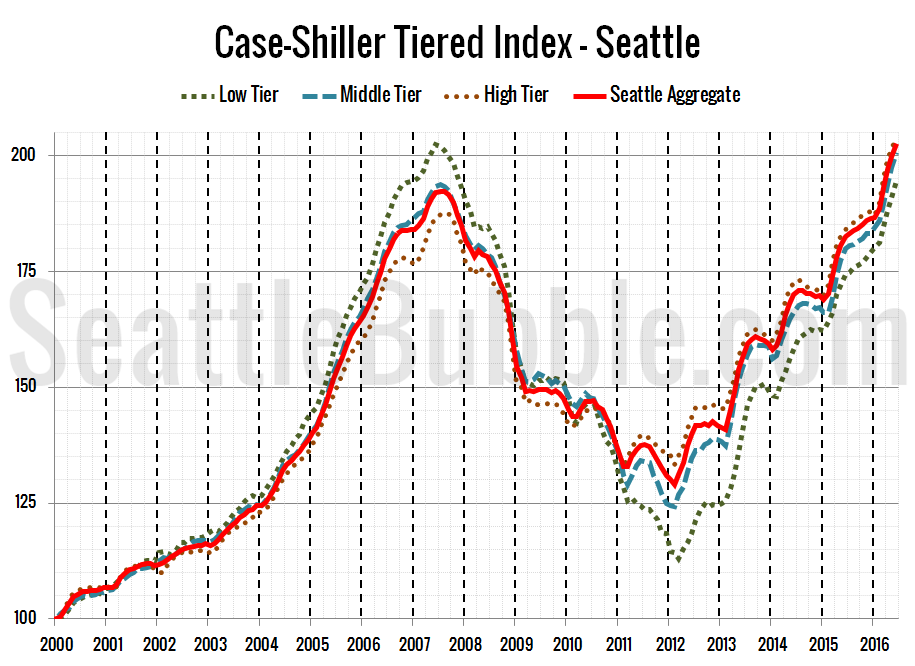

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

Note that the tiers are determined by sale volume. In other words, 1/3 of all sales fall into each tier. For more details on the tier methodologies, hit the full methodology pdf. Here are the current tier breakpoints:

- Low Tier: < $322,535 (up 1.3%)

- Mid Tier: $322,535 – $515,661

- Hi Tier: > $515,661 (up 1.2%)

First up is the straight graph of the index from January 2000 through June 2016.

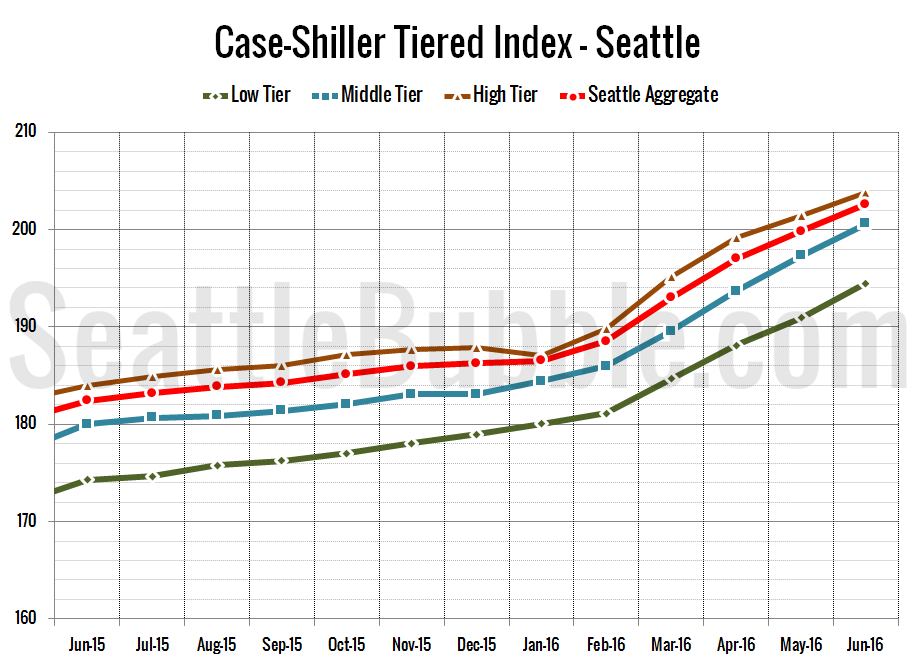

Here’s a zoom-in, showing just the last year:

All three tiers were still rising steadily as of June.

Between May and June, the low tier increased 1.9 percent, the middle tier rose 1.7 percent, and the high tier was up 1.2 percent.

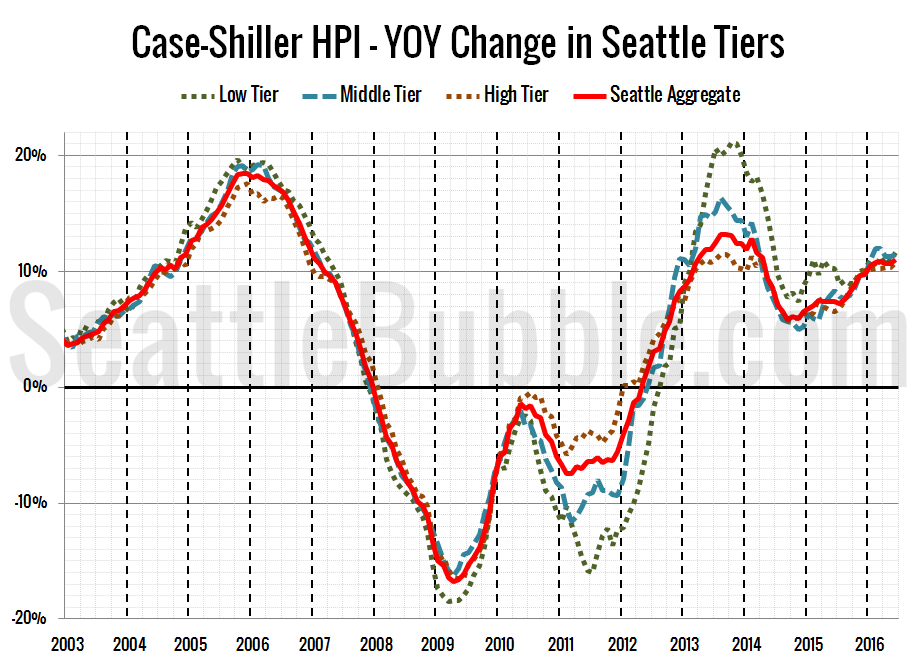

Here’s a chart of the year-over-year change in the index from January 2003 through June 2016.

Year-over-year price growth in June was larger than it was in May for all three tiers. Prices in all three tiers are still double-digits above last year’s levels. Here’s where the tiers sit YOY as of June – Low: +11.6 percent, Med: +11.4 percent, Hi: +10.8 percent.

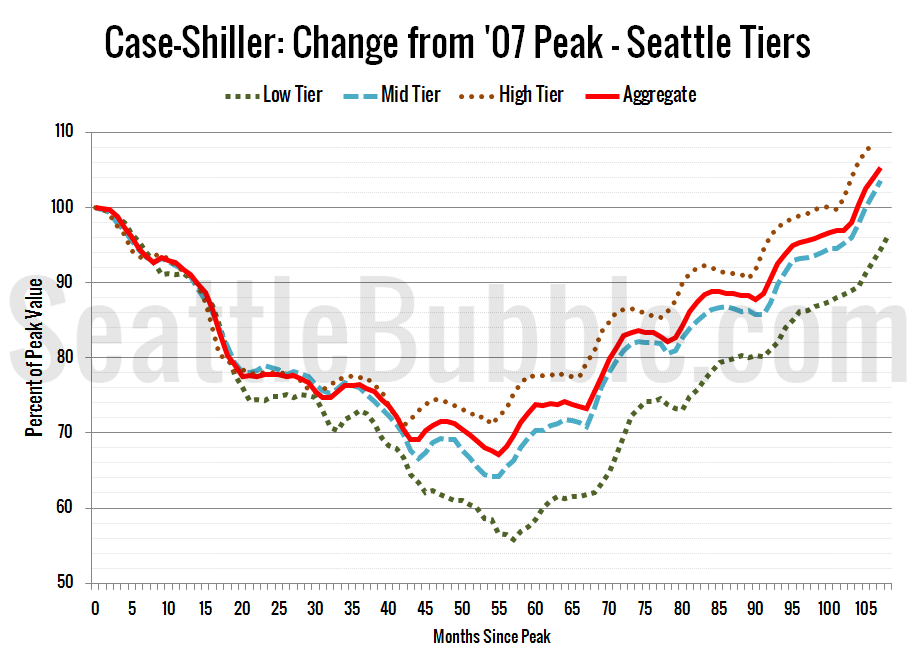

Lastly, here’s a decline-from-peak graph like the one posted yesterday for the various Case-Shiller markets, but looking only at the Seattle tiers.

Current standing is 3.9 percent below peak for the low tier, 3.5 percent above the 2007 peak for the middle tier, and 8.6 percent above the 2007 peak for the high tier.

(Home Price Indices, Standard & Poor’s, 2016-08-30)