Let’s check in on how Consumer Confidence and mortgage interest rates fared during January. First up, here’s the Consumer Confidence data as of March: At 81.0, the Present Situation Index increased 0.7% between February and March, and is up 34% from a year earlier. The Present Situation Index is currently up 301% from its December…

Author: The Tim

Weekly Open Thread (2014-03-31)

NOTE: If you are subscribed to Seattle Bubble’s RSS feed and are seeing these open threads in the feed, please switch to our official feed at http://feeds.feedburner.com/SeattleBubble Thanks! Here is your open thread for the week of March 31st, 2014. You may post random links and off-topic discussions here. Also, if you have an idea…

Poll: Do you consider natural disasters when buying a home?

This poll was active 03.30.2014 through 04.05.2014

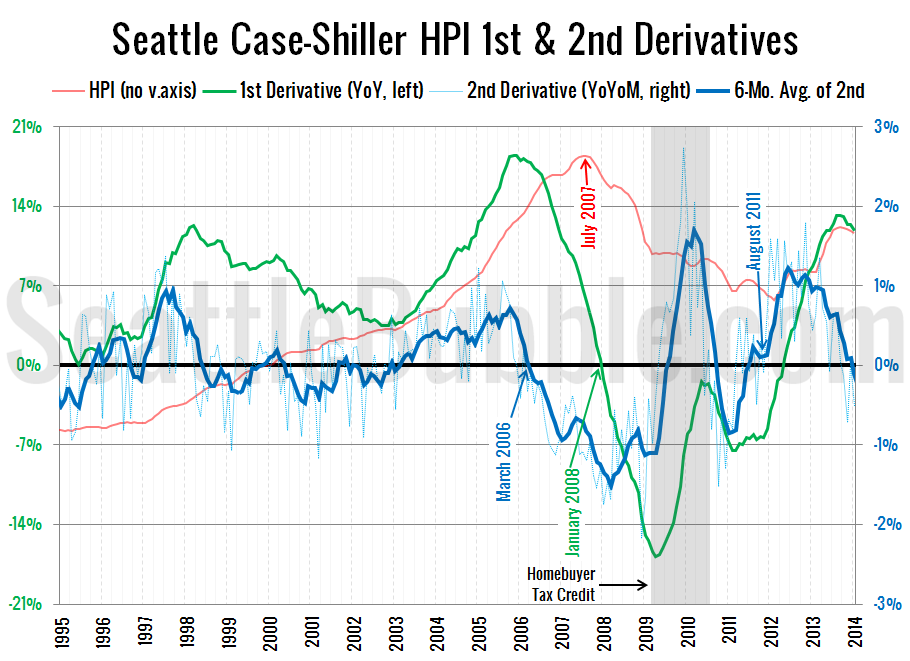

Case-Shiller Second Derivative Suggests Softer Prices

A reader requested an update to the second derivative chart of Seattle home prices, so here we go. This is a chart of the rate of change in the year-over-year change—the second derivative. For a more detailed explanation and some highlights of past inflection points, check out the original 2012 introduction of this chart. Here’s…

Case-Shiller: Home Prices Weakest Since Early 2012

Before we put away the January Case-Shiller data, let’s have a look at my favorite alternative Case-Shiller charts. First up, let’s take a look at the twenty-city month-over-month scorecard. Here’s the original post introducing this chart if you’d like more details. Click the image below for a super-wide version with the data back through 2000….