Market Psychology

I found this article to be an accurate summary of what is wrong in housing. To sum it up.

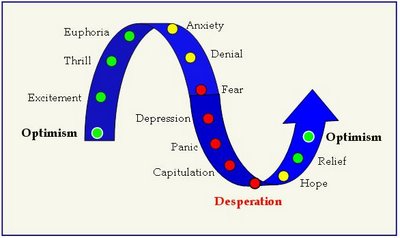

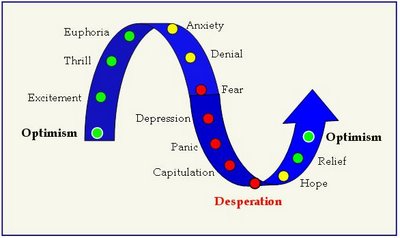

My favorite part is this diagram near the bottom.

The author claims we are somewhere between Denial and Fear, which is probably true on a national level. Locally, I think we are between anxiety and fear. While this is not a mathematically derived diagram, I think it makes a lot of historical sense.

What's frightening to me is how slowly housing market psychology is moving. Seattle was euphoric summer of 2007. It's anxious or in denial now, a full year later. Nationally, things are moving as slowly. Is it possible that the crash could be equally slow? In 2008, could we be just to the fear stage, and not reach panic until 2009 when some houses have now been on the market 2 years? Might we see 2010 usher in desperation as everyone wants out of housing no matter that cost?

To me, that paints a somewhat scary and yet possible scenario.

My favorite part is this diagram near the bottom.

The author claims we are somewhere between Denial and Fear, which is probably true on a national level. Locally, I think we are between anxiety and fear. While this is not a mathematically derived diagram, I think it makes a lot of historical sense.

What's frightening to me is how slowly housing market psychology is moving. Seattle was euphoric summer of 2007. It's anxious or in denial now, a full year later. Nationally, things are moving as slowly. Is it possible that the crash could be equally slow? In 2008, could we be just to the fear stage, and not reach panic until 2009 when some houses have now been on the market 2 years? Might we see 2010 usher in desperation as everyone wants out of housing no matter that cost?

To me, that paints a somewhat scary and yet possible scenario.