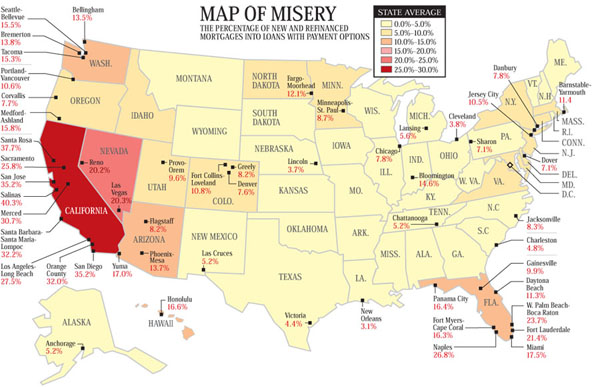

A pair of maps containing interesting statistics surfaced in the past few weeks that are worth sharing here. First is the “Map of Misery” from BusinessWeek, showing “the percentage of new and refinanced mortgages into loans with payment options.” This is important to note, because as BusinessWeek explains:

The option adjustable rate mortgage (ARM) might be the riskiest and most complicated home loan product ever created. With its temptingly low minimum payments, the option ARM brought a whole new group of buyers into the housing market, extending the boom longer than it could have otherwise lasted, especially in the hottest markets. Suddenly, almost anyone could afford a home — or so they thought. The option ARM’s low payments are only temporary. And the less a borrower chooses to pay now, the more is tacked onto the balance.

The bill is coming due. Many of the option ARMs taken out in 2004 and 2005 are resetting at much higher payment schedules — often to the astonishment of people who thought the low installments were fixed for at least five years. And because home prices have leveled off, borrowers can’t count on rising equity to bail them out. What’s more, steep penalties prevent them from refinancing. The most diligent home buyers asked enough questions to know that option ARMs can be fraught with risk. But others, caught up in real estate mania, ignored or failed to appreciate the risk.

As you can see, the Seattle area is right up at the top, with only portions of California, Nevada, and Florida having a larger percentage of option ARM loans. Note that this only includes option ARM, and does not include interest-only loans or other ARM products. Who knows how high that number would be if it did.

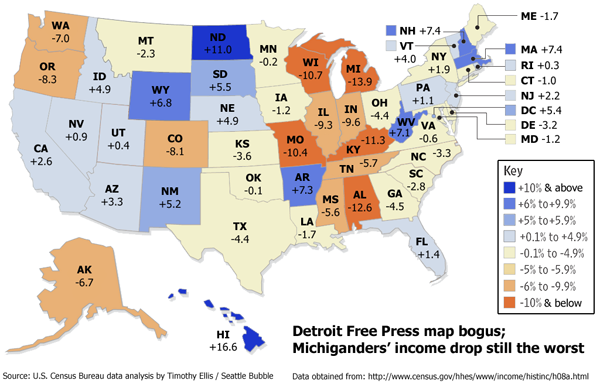

The second map comes courtesy of the Detroit Free Press, and shows the difference in inflation-adjusted median household income from 1999 to 2005. (Correction: The Detroit Free Press used inappropriate statistical methods, leading to incorrect values on the original map. The below map is a corrected version generated by yours truly. See this post for details.)

So, during a time when wages have decreased 7.0%, home prices have doubled, defying all logic. How is this possible? Sure, low interest rates were a factor, but they only dropped about two points from 1999 to 2003. That does not explain 100% home price appreciation. No, the primary culprit is certainly the ready availability of adjustable-rate mortgages, including a large number of option ARMs. Too many people have been swept up in home ownership psychosis, and have been all-too-willing to jump head-first into dangerous financing.

And yet there are still those that insist that our housing market is 100% healthy.

(Cover Story, Business Week, 09.01.2006)

(John W. Fleming, Detroit Free Press, 08.30.2006)