As the mortgage industry begins to crumble and home prices are declining across the nation, the local media and blogging real estate insiders seem to be getting a bit anxious. Maybe it’s just me, but take a look at some of the recent headlines:

Home values here still rising (Elizabeth Rhodes, Seattle Times)

Seattle-area homes are holding value, Zillow says (Aubrey Cohen, Seattle P-I)

No, Chicken Little, the sky isn’t falling… (Reba Haas, Rain City Guide)

Many recent reports such as these seem to have a tone of: “I swear, the housing market in Seattle is still strong! The mortgage mess won’t affect us at all, really!” Who can blame them, really? What else are people whose income depends on the continued strong performance of the local market going to say?

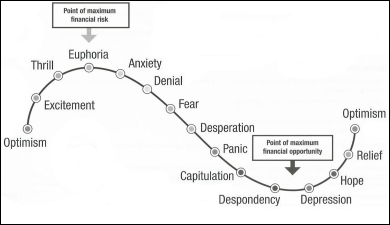

You’ve probably all seen the “Cycle of Market Emotions” on other housing blogs:

Although it takes an ounce of actual critical thinking to see the cracks in Seattle’s housing market as of now, I believe that those most involved in the market can feel it in their bones. Whether they are consciously aware of it or not, the fear of what’s about to happen is starting to come through in what they write. Based on what I’m reading out there, I would place the general market sentiment in Seattle right now at somewhere between “Anxiety” and “Denial.”

Of course, some people are more willing than others to be frank about the situation facing us today. To her credit, Jillayne Schlicke over at Rain City Guide appears to be one of them, recommending in a frank post about the snowballing troubles at Countrywide, she recommends that employees there “polish your resumes and quietly begin making inquiries.”

And let’s not forget our old friend at the P-I, Bill Virgin, who pipes in on the ongoing mess with his usual wit and insight:

You can’t help reading the accumulating horror stories in the mortgage market… without shaking your head and wondering, “What were they thinking?”

Not the borrowers. The people making the loans.

The borrowers certainly deserve to be asked, “What were you thinking?” The explanations offered in answer range from, “I didn’t read it” to “They didn’t explain this to me” to “Maybe I fudged the numbers a bit” to “I didn’t count on my job/the housing market/ interest rates/the economy going bad on me.”

If ignorance born of laziness is unattractive in consumers, it’s inexcusable for the industry that was generating and selling these loans. Alternative explanations are hardly more absolving: Inexperience (“Housing markets only go up, right?”), hubris (“I know what I’m doing, those other clowns don’t.”) or greed (“As long as I get the loan made and sold, it’s not my problem.”).

The real world is not tolerant of such excuses, and it is a harsh grader on those who ignored, or never learned, the principles of responsible financial management.

Of course, it’s my opinion that anyone who didn’t see this kind of mess coming years ago was either not paying attention or willfully ignorant. I leave it as an exercise to the reader to determine which group of people falls into each category.

Who can say how this is all going to unfold in the coming months and years. All I know for sure is that these are definitely interesting times.

(Elizabeth Rhodes, Seattle Times, 08.18.2007)

(Aubrey Cohen, Source, 08.13.2007)

(Reba Haas, Rain City Guide, 08.18.2007)

(Jillayne Schlicke, Rain City Guide, 08.20.2007)

(Bill Virgin, Seattle P-I, 08.20.2007)