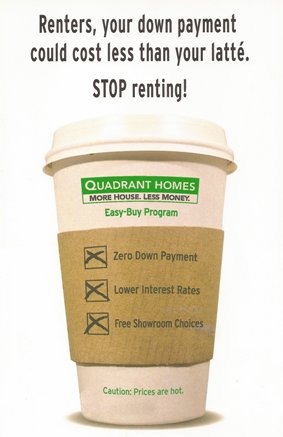

I got this in the mail earlier this week, and just had to share. Houses are still cheaper than latte’s, apparently…

[Addendum]

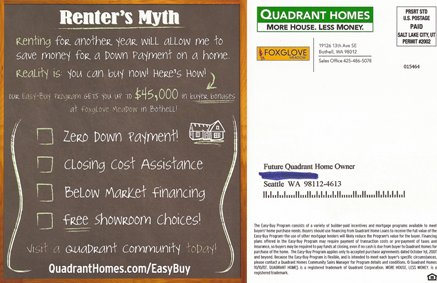

I clicked through to the site that the postcard directs you to. The “bonuses” are pretty significant relative to the starting prices, it seems to me.

Buyer Bonuses at Select Communities

For purchases on October 1, 2007 and beyond, get up to…

- $25,000 at Autumn Woods in Spanaway (homes from the low $200s)

- $20,000 at Berrywoods in Marysville (homes from the mid $200s)

- $30,000 at Brookside in Bonney Lake (homes from the mid $200s)

- $22,000 at Deschutes River Highlands in Olympia (homes from the mid $200s)

- $30,000 at Fern Crest in Kent (homes from the low $300s)

- $45,000 at Foxglove Meadow in Bothell (homes from the high $300s)

- $30,000 at Kentlake Highlands in Lake Sawyer area (homes from the low $300s)

- $30,000 at Northwest Landing in DuPont (homes from the mid $200s)

- $15,000 at Pasadera in Lake Stevens (homes from the mid $200s)

- $40,000 at Pasadera Heights in Lake Stevens (homes from the high $200s)

- $18,000 at Ridge at McCormick Woods in Port Orchard area (homes from the mid $200s)

- $17,000 at Skagit Highlands in Mount Vernon (homes from the high $100s)

- $15,000 at Stendahl Ridge in Poulsbo (homes from the mid $200s)

- $22,000 at Ridge at Suncrest in Tumwater (homes from the low $200s)

- $20,000 at Tahoma Meadow in Yelm (homes from the high $100s)