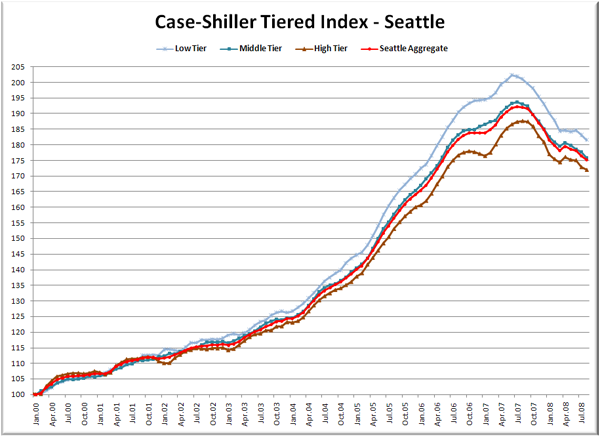

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

First up is the straight graph of the index from January 2000 through August 2008.

Price drops continued in August at roughly the same pace for all three tiers. The low tier and mid tiers are still rewound to May 2006 with the high tier at June 2006 levels. The middle tier took the biggest hit in August, falling just under two points, or 1.1% in one month.

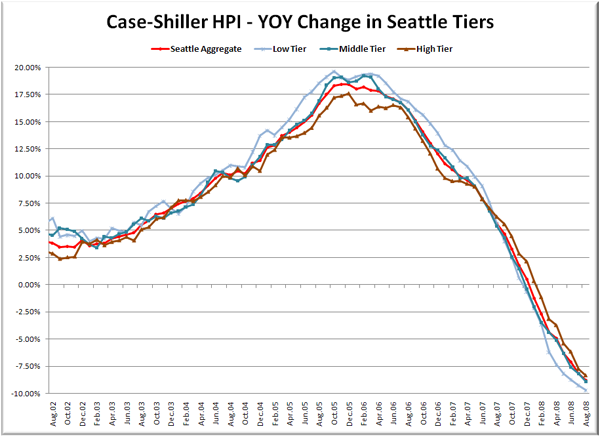

Here’s a chart of the year-over-year change in the index from August 2002 through August 2008.

The low tier continues to take the biggest year-over-year hit, with declines reaching almost ten percent in August. Here’s where the tiers sit YOY as of August – Low: -9.7%, Med: -8.9%, Hi: -8.4%.

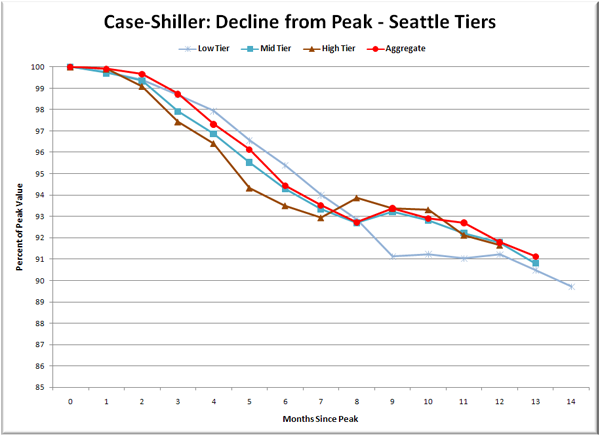

Lastly, here’s a decline-from-peak graph like the one posted yesterday, but looking only at the Seattle tiers.

After the low tier bounced down further than the other two tiers in post-peak months nine through eleven, everything has fallen back into roughly the same territory. The low tier still has the largest overall drop for every post-peak month since number nine. As predicted last month, the low tier has now lost over 10% from the peak.

(Home Price Indices, Standard & Poor’s, 10.28.2008)