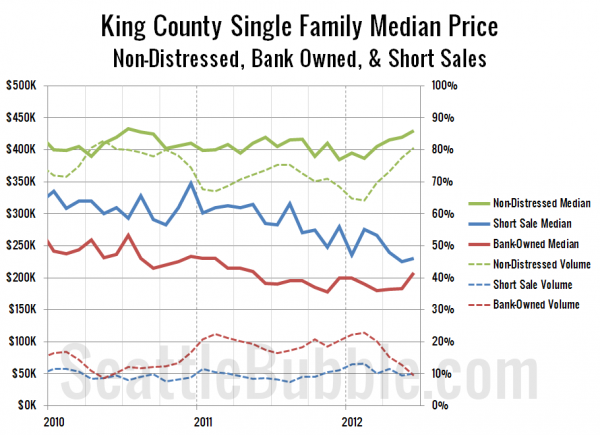

In the comments on last week’s NWMLS stats post some readers asked what the median price would look like if you removed the distressed sales from the mix. Here’s the answer:

As of June, the non-distressed median price for King County single family home sales sits at $430,000, up 2.4% from a year earlier. The low point for the non-distressed median was $384,500 last December. We don’t have consistent, complete data separating bank owned homes and short sales from other sales before 2010, but the high point since January 2010 so far is $432,500 in July 2010, so non-distressed prices have been basically flat (bouncing up and down with the seasons) for the last two years.

Meanwhile, the median price for bank owned homes and short sales have both been on a fairly steady downward trend over the last two years, falling 14% and 31% from January 2010 to June 2012, respectively.

Of course, even when you factor out the bank owned and distressed sales from the mix, keep in mind that the median price is also affected by the geographic mix of sales, which is not addressed in the chart above. However, this does a good job of visualizing exactly what I said last Thursday:

Home prices are indeed going up, but when you account for [the decreasing share of sales of bank owned homes] the increase is much less severe.

I’d say +2.4% is a lot less severe of an increase than 10.0%, wouldn’t you?