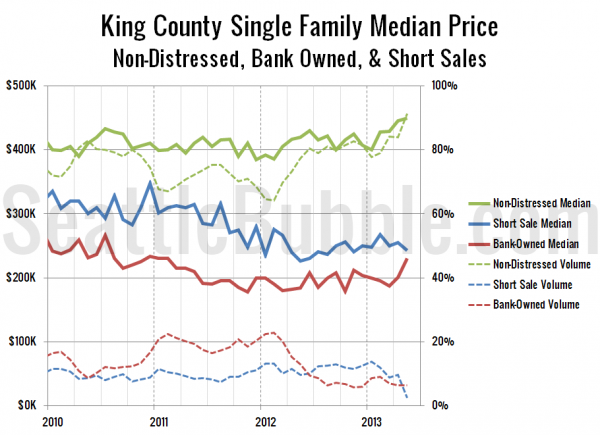

As promised on Wednesday, it’s time to check up on median home sale prices broken down by distress status: Non-distressed, bank-owned, and short sales.

As of May, the non-distressed median price for King County single family home sales sits at $449,000, up 6.9% from a year earlier and up 0.9% from April. Last year the month-over-month increase was about the same, up 0.7% April to May.

The bank-owned median sale price was at $229,950 in May, up a whopping 25.2% from a year earlier. The short sale median price came in at $242,500 in May, up 7.1% from 2012.

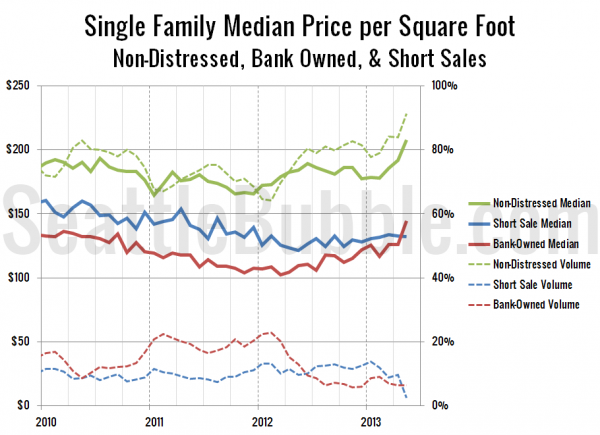

Here’s a look at the price per square foot broken down by distress status:

The median price per square foot of non-distressed homes was actually up more than the raw median, gaining 12.9% from 2012. The bank-owned median price per square foot shot up 32.0%, while the short sale median price per square foot was up 9.1%. This is the first time the bank-owned median price per square foot has come in higher than the short sale median price per square foot.

With the share of sales that are distressed now below 10%, these charts are quickly becoming less interesting than they were when bank-owned and short sales made up a third of the market.