New local job stats came out this week, so let’s have a look at the Seattle area’s employment situation.

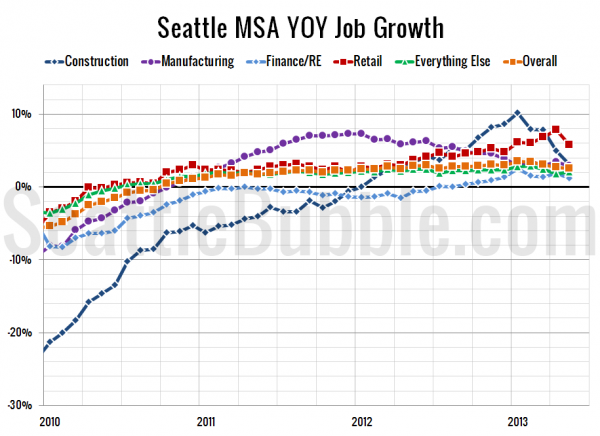

First up, year-over-year job growth, broken down into a few relevant sectors:

Construction growth dipped again, and has fallen from a 10.2% year-over-year gain in January to 3.1% in May. With 5.7% year-over-year growth, the retail sector was again the fastest-growing in May.

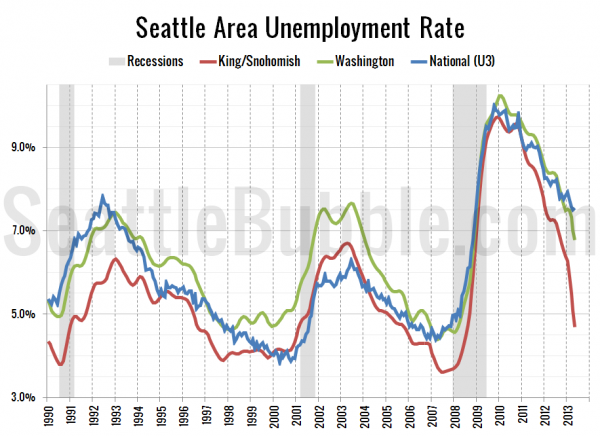

Here’s a look at the overall Seattle area unemployment rate compared to the national rate:

Unemployment dipped below 5% in the Seattle area in May for the first time since late 2008. Washington State unemployment dipped as well, falling below 7% for the first time since late 2008, but the national level inched up. Washington State’s unemployment is still below the national rate, while the Seattle area continues to do much better than Washington State and the nation as a whole. May unemployment came in at 7.6% for the US, 6.8% for Washington, and 4.7% for the Seattle area.

- Seattle Job Levels: Washington State Employment Security Department

- Seattle & Washington Unemployment: Washington State Employment Security Department

- National Unemployment: Bureau of Labor Statistics

Seasonally adjusted series used for all data sets.