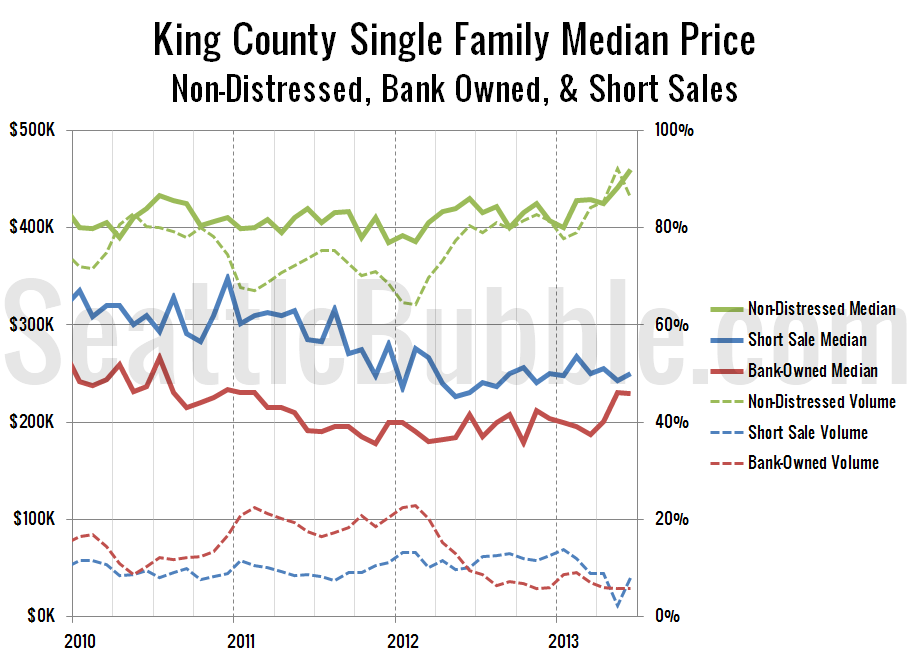

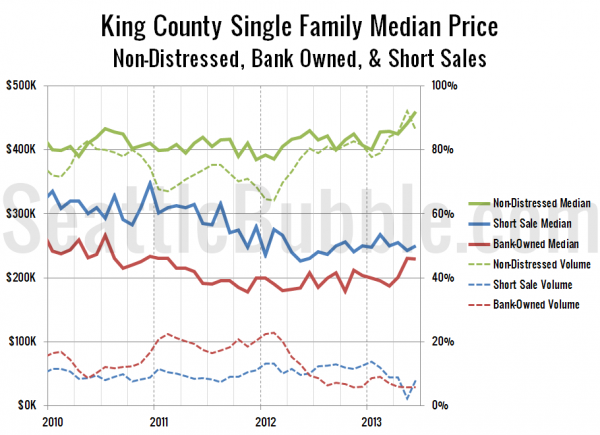

As promised earlier this week, it’s time to check up on median home sale prices broken down by distress status: Non-distressed, bank-owned, and short sales.

As of June, the non-distressed median price for King County single family home sales sits at $460,000, up 7.0% from a year earlier and up 4.3% from May. Last year the month-over-month increase was 2.4% May to June.

The bank-owned median sale price was at $229,000 in June, up 10.1% from a year earlier and down slightly from May. The short sale median price came in at $250,000 in June, up 8.7% from 2012 and up 3.1% from May.

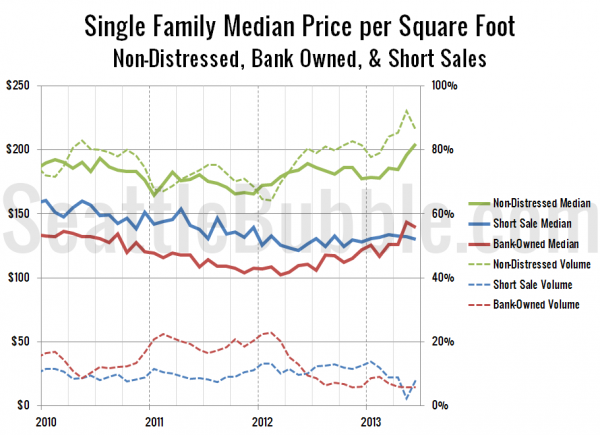

Here’s a look at the price per square foot broken down by distress status:

The median price per square foot of non-distressed homes was up more than the raw median again, gaining 8.3% from 2012. The bank-owned median price per square foot rose 26.4%, while the short sale median price per square foot was up just 3.0%.

Next week we’ll take a look at how sales were distributed around the county, since that has more of an effect on the change in the overall median than distressed sales, now that REO and short sales only account for 14% of the market.