Don’t worry: This will be my last post about the shadow inventory issue for quite some time.

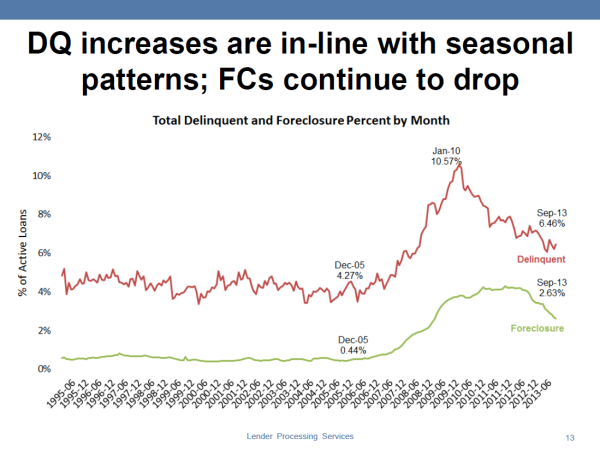

In last Friday’s post about shadow inventory, “Haybaler” shared a great link in which Calculated Risk reported LPS delinquency data for September. This data addresses the main complaint some of you have raised about my previous analysis of shadow inventory: homes that have not received a notice of trustee sale despite being delinquent for much more than 90 days—the undocumented shadow inventory.

LPS data showed 4,593,000 loans across the country were delinquent or in foreclosure. They say that represents 9.03% of all mortgages, which puts their count of the total number of mortgages in the country at around 50,863,787. Of those homes that are delinquent, 1,331,000 are “90 or more days delinquent, but not in foreclosure,” i.e. the undocumented shadow inventory. I’m not counting homes that are less than 90 days delinquent because 90 days is the earliest that a homeowner in Washington State could receive a notice of trustee sale (see the Washington State foreclosure timeline).

To figure out King County’s share of total mortgages, we’ll use 2012 data (the most recent available) from the US Census Bureau. They show 132,452,405 housing units in the country in 2012. Of those, 74,119,256 were owner-occupied, and 48,726,257 had a mortgage. King County had 859,736 total housing units, 457,472 owner-occupied housing units, and 345,006 with a mortgage.

That puts King County’s total share of mortgages at 0.708% of the national total. If delinquencies were spread evenly across the entire population (which we know they are not—i.e. Tacoma has a lot more than Seattle), that would mean there are 9,423 shadow inventory properties in King County as of September (1,331,000 × 0.00708).

Since April, an average of 3,027 homes (SFH+condo) have sold each month in King County. In other words, the high end estimate of undocumented shadow inventory in King County based on sourced delinquency data is equivalent to roughly three months of supply. Since we know that King County has a lot fewer foreclosures than the national average, actual amount of shadow inventory is most likely a lot lower. If every single home in the high end estimate of undocumented shadow inventory suddenly came on the market tomorrow (which would obviously never happen), months of supply would increase from 1.9 to 4.9—still in seller’s market territory, which is generally considered anything below six months of supply.

Of course in reality, these homes will filter through the foreclosure process and trickle onto the market spread out over the next few years. If we assume that 9,423 homes (there are most likely far fewer homes) come on the market spread evenly across the next two years (it will most likely take even longer), the 393 additional homes added to the market each month would add just 0.2 months of supply at September’s rate of sales—a drop in the bucket.

Perma-bears are now invited to share more “signs” and “common sense” about how looming shadow inventory will somehow bring about another crash or otherwise dramatically affect the housing market.