It’s time once again to take an updated look at how King County’s sales are shifting between the different regions around the county, since geographic shifts can and do affect the median price.

In order to explore this concept, we break King County down into three regions, based on the NWMLS-defined “areas”:

- low end: South County (areas 100-130 & 300-360)

- mid range: Seattle / North County (areas 140, 380-390, & 700-800)

- high end: Eastside (areas 500-600)

Here’s where each region’s median prices came in as of September data:

- low end: $227,000-$364,000

- mid range: $335,000-$715,000

- high end: $500,000-$1,599,500

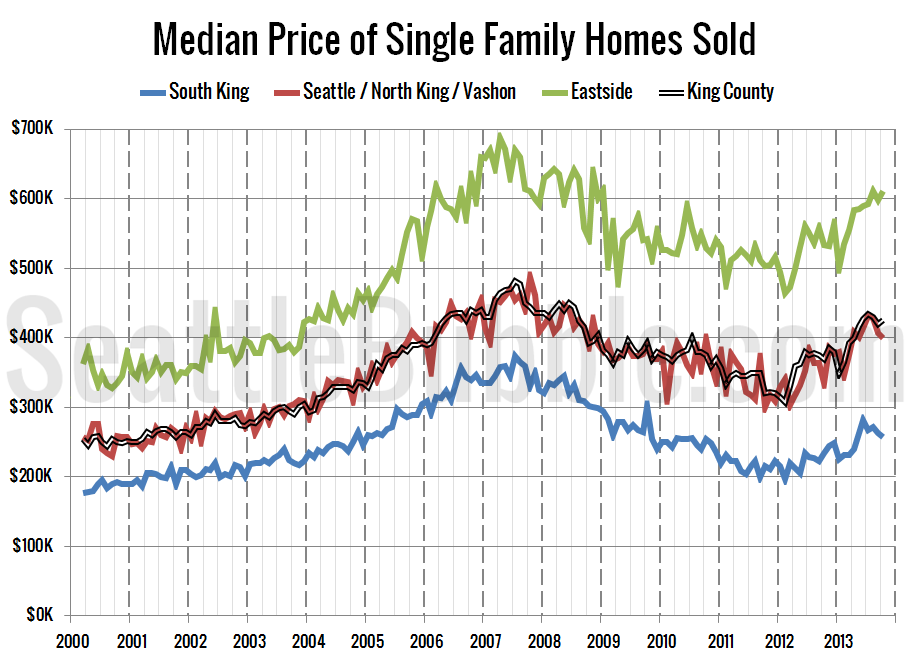

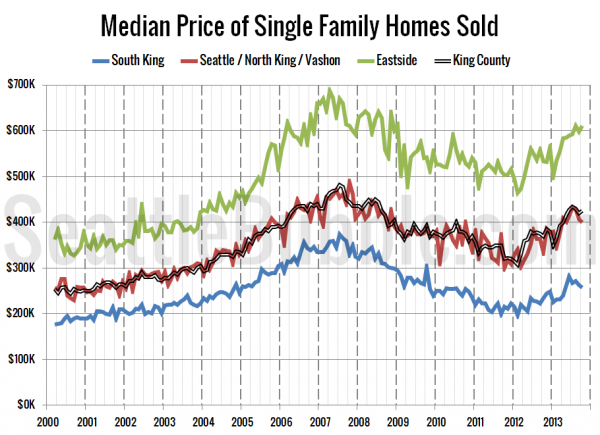

First up, let’s have a look at each region’s (approximate) median price (actually the median of the medians for each area within the region).

The median price in the low and middle tiers fell between September and October, while the high tier saw a slight increase. The low tier dropped 2.2% in the month, the middle tier fell 1.8%, and the high tier gained 2.2%. All three tiers are still up year-over-year. Low tier: +9.6%, middle tier: +19.2%, high tier: +14.4%.

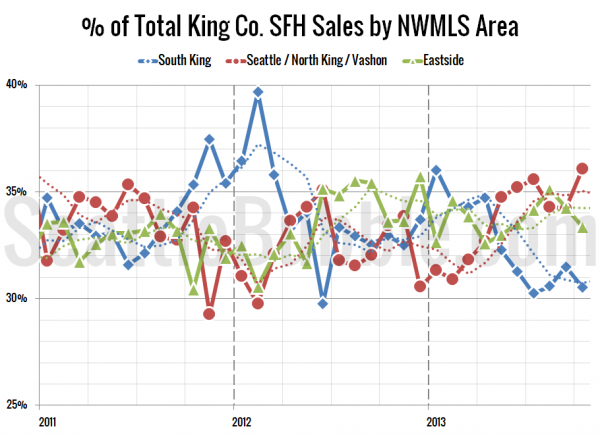

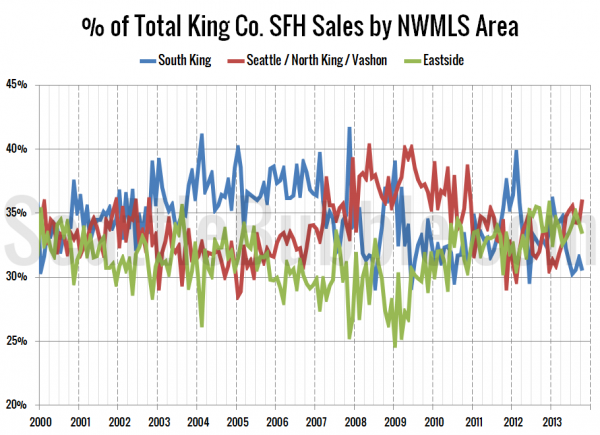

Next up, the percentage of each month’s closed sales that took place in each of the three regions. The dotted line is a four-month rolling average.

The share of sales that are taking place in the most expensive parts and the cheapest parts of the county fell slightly last month, while sales share in Seattle increased.

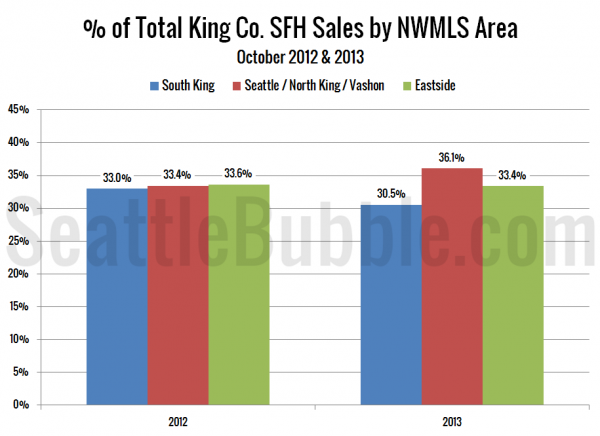

As of October 2013, 30.5% of sales were in the low end regions, 36.1% in the mid range, and 33.4% in the high end. A year ago the split was much more balanced: In October 2012 the low end made up 33.0% of the sales, the mid range was 33.4%, and the high end was 33.6%.

Here’s that information in a visual format:

Finally, here’s an updated look at the percentage of sales data all the way back through 2000:

The high end regions have quickly gone from the smallest share of sales to the largest share, while the low end regions have flipped the other way. The result of that switch is likely to move the overall median price up considerably, as more sales take place in expensive regions than cheap ones.