A common belief (one that I’ve repeated a couple of times here) is that housing trends in the Northwest tend to lag California and the nation as a whole by six months to a year. Obviously we cannot know exactly what will happen here, but if we have generally followed California and the national averages in the past, then we can look to them to get a general idea of where our housing market is headed in the near future.

Let’s take a look at some graphs to see if the theory holds any water. All of the following graphs are from the Case-Shiller Index, which tracks same-home sales in 20 markets across the country, including Seattle:

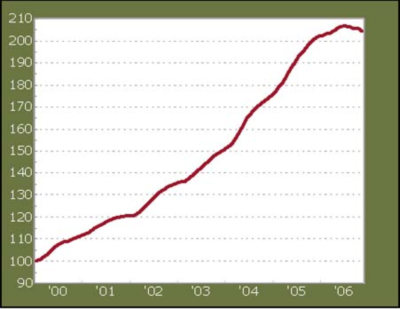

As we all no doubt already know, Seattle has experienced quite a climb in prices in the last few years. You can see in the graph that the gains really started to pick up steam around 2003-2004, but things seem to be leveling off presently.

San Diego’s rapid gains began in earnest 2002-2003, but they leveled off in 2005, and actually declined in 2006. Hmm, interesting.

The composite graph appears to shoot up in 2003-2004, with a peak in early 2006, and declines since then. (Note that the composite graph tracks only 2000-present.)

Already you can probably see that on the way up, Seattle did in fact seem to lag the other two graphs. To help us visualize, I took the San Diego graph, and overlaid Seattle onto it, shifting Seattle one year back:

While they are of course not a perfect match, you can see that when Seattle is shifted back a year, both lines become suddenly steeper around the same point, and they both level off around the same point. This would seem to confirm the theory that Seattle’s housing cycle has been lagging California (or San Diego at least) by approximately one year.

Here is the Composite-20 graph, with Seattle overlaid and shifted back by six months:

That looks like a pretty good match, too, with the two tracking very closely since midway through ’03.

So what’s the conclusion? During the recent unprecedented run-up in home prices, price growth in Seattle has lagged the nation as a whole by roughly six months, and San Diego by approximately a year. Both of these measures have shown real price declines in the past year, despite many positive factors (such as job growth, low unemployment, good interest rates, etc.).

Therefore, a reasonable person would conclude that there is a very real possibility that Seattle will also experience price declines in the coming year. On the flip side, a willfully igorant person would conclude that “Seattle is special” and we are totally shielded from experiencing similar price drops.

Declining prices are not by any means certain to happen, but ignoring the evidence that points to such a conclusion seems to me to be a pretty dumb move.

(S&P/Case-Shiller® Index, MacroMarkets, 01.2007)