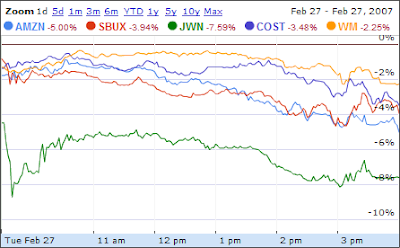

Update: By request, here is a graph of today’s stock performance for a handful of other locally-based companies.

For those of you keeping score at home:

- Boeing: -1.95%

- Microsoft: -4.12%

- Amazon: -5.00%

- Starbucks: -3.94%

- Nordstrom: -7.59%

- Costco: -3.48%

- Washington Mutual: -2.25%

Some immunity.