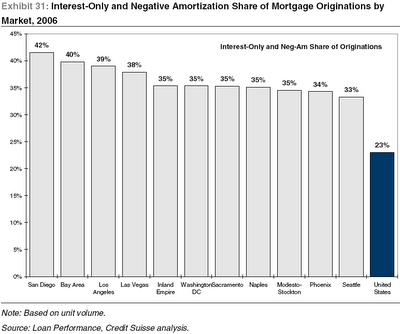

As you know, I haven’t said much on this blog about the ongoing collapse of lending as we’ve known it the last few years. This is primarily because the issue is being covered quite thoroughly at many of the other bubble blogs linked on the sidebar. However, a reader sent me a pdf report by Credit Suisse titled “Mortgage Liquidity du Jour: Underestimated No More” that contained the following chart:

As you can see, home buyers in Seattle have turned to interest-only and neg-am loans just about as frequently as most of the other “bubbly” cities.

As this easy money rapidly dries up, where does that leave the buyers? Well, I’ll defer to the opinion of a “Mortgage Expert” on that one (comment #2):

It’s a real feeling of panic for buyers.

Uh-oh, it looks like we may not be as special as we thought. It would appear that all of Seattle’s pretty scenery and “world class” amenities don’t count for diddly when loans are no longer being handed out like bread crumbs at the duck pond.

P.S. (I have the report in pdf format, thanks to the reader that emailed it to me, but since I could not find a web link to it, and I don’t know the copyright status of it, I have not posted the report online. If someone finds a link to the full report I will add it to the post.)