The latest report from the PMI Group has been released, and the news is increasingly bad for Seattle:

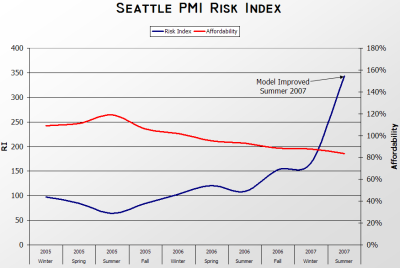

As noted on the graph, PMI did improve their model with this latest report, so while Seattle’s new Risk Index of 343 is not directly comparable to its previous index of 167, the news still doesn’t bode well for Seattle home prices.

Of course, the local press puts the most positive spin possible on the news. The headline takes the cake: Home prices likely to hold steady, study suggests

Will the typical home cost less in two years than it does today? That’s the question a new study attempts to answer for the nation’s 50 largest metropolitan areas.

Seattle has a 34.3 percent chance of lower prices in two years — the 25th-highest risk and just under the population-weighted average of 34.6 percent in the summer U.S. Market Risk Index that PMI Mortgage Insurance Co. released Tuesday.

“This bodes well for the market there, in addition to the fact that Seattle has relatively really good affordability … and a solid employment market,” said LaVaughn Henry, director of economic analysis for PMI.

…

The changes to the PMI index, which led the company to skip its spring report, give additional weight to recent price volatility.Seattle ranked 18th for price volatility, with a higher rank meaning more volatility.

From the perspective of many Seattle residents, home prices shot up quickly to very unaffordable levels. Affordability is down 4.9 percent from six months ago and 10.5 percent from a year ago, but Seattle’s affordability rank remained relatively steady, going from 23rd a year ago to 25th six months ago to 24th now, with a higher rank meaning homes are less affordable.

The likelihood of price declines in Seattle in the next two years, while low, is higher than it was six months and a year ago, although new changes in PMI’s model make comparisons less valid. The metro area’s chance of declines was 16.7 percent six months ago, putting it 32nd among the top 50 areas, and 10.9 percent a year ago, good for 33rd place.

But never mind all that. There’s never been a better time to buy. Get on the equity ladder now, any way you can.

(Aubrey Cohen, Seattle P-I, 06.19.2007)

(The PMI Group,Spring/Summer 2007 Report, 06.2007)