August stats have finally been run by the NWMLS. Thanks to my inside source, you can find the info here first.

When they publish the usual monthly press release with links to the recap pdfs, I’ll post it here. Update: Here’s a link to the press release: Key Indicators for August Home Sales Around Washington Show Continuing Trend of Fewer Sales, Higher Prices. From there you can link to the recap pdf and the county breakouts.

Here’s your King County SFH summary:

August 2007

Active Listings: up 43% YOY

Pending Sales: down 26% YOY

Median Closed Price*: $477,345, up 9.7% YOY

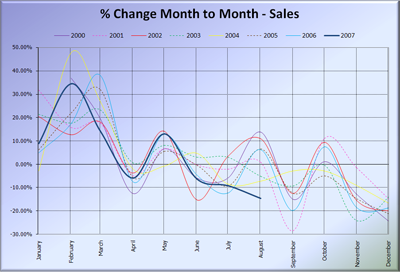

Wow. The big story this month is sales down 26% YOY. That’s the largest YOY drop since statistics have been available (2000). The raw amount of sales (2,094) is the lowest for any August since (at least) before 2000 as well. It will be amusing to see what kind of excuses the real estate sales community comes up with this time. I’m pretty sure “bad weather” is out. Maybe they’ll go with “the weather was so good that everyone was out enjoying it instead of buying houses.”

Inventory continued its usual YOY climb, clocking in almost the exact same YOY jump as last month.

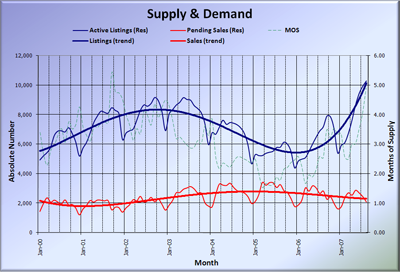

The combination of record-high inventory and record-low sales have bumped the Months of Supply measure to 4.9—nearly double what it was in August of last year.

Median prices dropped back down a bit, not unusual for August. Don’t forget to keep in mind the huge caveats that come with looking at the median, especially as sales begin to drop so significantly.

You know the routine. Download a copy of the updated Seattle Bubble Spreadsheet with highly-concentrated data goodness.

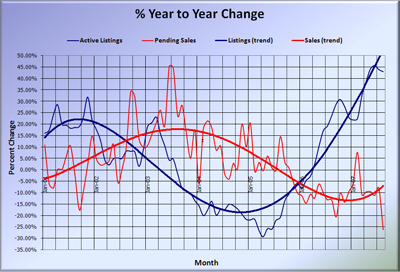

Here’s the supply/demand YOY graph:

Here’s the chart of supply and demand raw numbers:

Just to give you an idea of how unusual this drop in sales is, here’s a graph of the month-to-month change in sales for every year since 2000:

Update: Some of the phrasing of the NWMLS press release really cracked me up. Here’s a little translation guide for the marketing-speak that you’re likely to see regurgitated in the press today and tomorrow:

“plentiful selection in most areas” = Listings at an all-time high, up 46% YOY system-wide, over 60% in some areas.

“the market is adjusting to a slower but steady pace” = As long as you mean “steadily declining,” then yes, it’s “steady.”

“motivated sellers are more flexible than they’ve been in a long time” = Everybody’s trying to get out before the **** really hits the fan around here.

“home prices are still increasing, but at a slower pace” = Prices probably aren’t really increasing at all, but the lousy metric we use to measure prices is increasing, so we’ll say that they are.

“Prices surged 30 percent for single family homes that sold in San Juan County last month compared to a year ago.” = The whopping 20 homes that sold last month—in the smallest county we cover—tended to be more expensive than the 34 that sold a year prior.

It’s a riot!