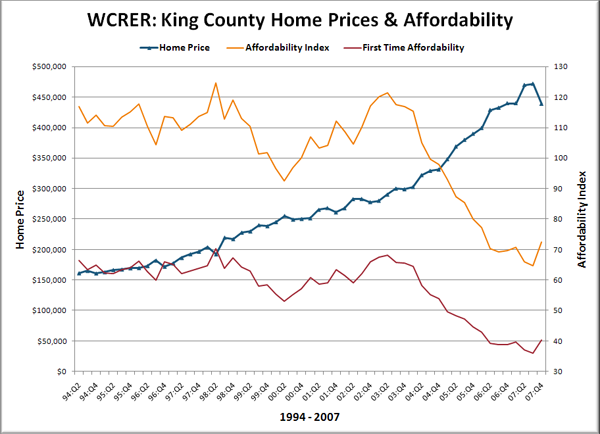

The Washington Center for Real Estate Research has released their data for the fourth quarter of 2007, and it finally has some good news for home buyers. According to the WCRER calculations, home prices in Q4 dropped 7% from the previous quarter ($472,000 to $439,000), which naturally edged the affordability index up slightly to a still-anemic 72.4.

Here’s a graph of their data on “Median Resale Price” and “Housing Affordability Index” since 1994, when they first started collecting data:

There’s really not much more to say about this data, as it just confirms what we have known for months; that home prices in King County are finally retreating. News reports and real estate agents are likely to latch onto the minuscule increase in affordability and trumpet it as proof that “now is a great time to buy.” When price declines have only just begun and affordability is still only 65% of its 1994-2003 average, now is definitely not a great time to buy.