Here’s the latest update on months of supply, or “absorption rates” for the 30 NWMLS areas in King County. For an explanation of what months of supply means, please refer to the original neighborhood MOS breakdown post.

Remember our metric: less than 6 MOS is a sellers market and above 6 is a buyer’s market, meaning that buyers have better negotiating power, not that homes are necessarily priced attractively for buyers. Before this year, the longest that King County as a whole has sustained a MOS above 6 was 4-5 months in the winter of 1994-1995. March MOS for King County came in at 6.19 (slightly higher than February), bringing the current run to seven months.

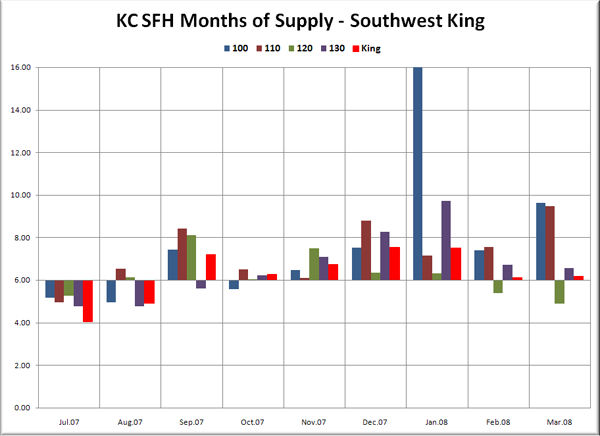

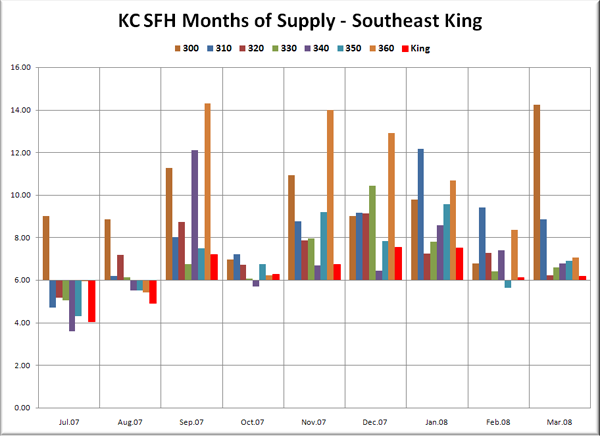

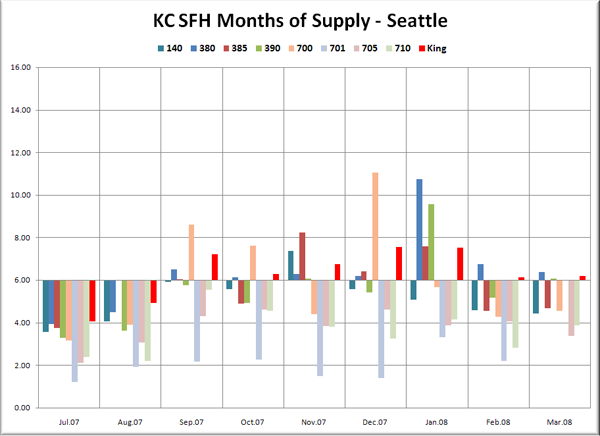

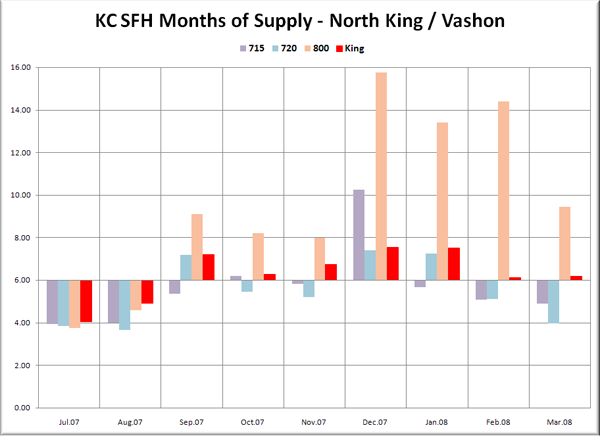

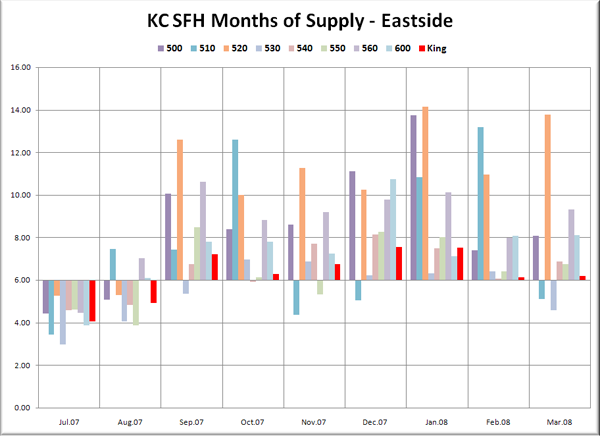

In the graphs below, you’re looking at the MOS for the “Res Only” data from the NWMLS King County Breakout pdfs for the nine-month period of July 2007 through March 2008. The bar graph is centered vertically on 6.0 MOS, so that it is easier to visually tell the difference between a seller’s and buyer’s market (i.e. – shorter bars mean a more balanced market). Each graph again has the same scale on the vertical axis and has the King County aggregate figure plotted in red, so they can be easily compared.

For a description of which neighborhoods each area encompasses, as well as a map of the areas and a link to the source data, visit this page.

Note: Area 100 MOS was over 21 in January, and has been clipped.

Note: For Area 701 (Downtown Seattle) we’re using condo data.

The best markets for sellers continue to be North Seattle areas 705 and 710 (Ballard, Greenlake, Greenwood, Lake City, Northgate, Wedgewood, etc.), with 3.38 and 3.86 MOS respectively. One other area dropped slighly below 4 MOS, area 720 (Lake Forest Park, Kenmore) with 3.95 MOS. The Seattle city limits as a whole are definitely still the worst place for buyers, with a collective MOS of just 4.52. However, even Seattle is trending strongly toward a buyer’s market, as this March saw over twice as many months of supply as last March, which had just 1.85 MOS.

The condo supply and demand situation downtown took a sudden turn in favor of buyers, with MOS shooting from 2.21 in February to 6.02 in March. Again though, I would take the condo statistics with a grain of salt, considering how many new construction condos never make it onto the MLS.

Ten of eleven neighborhoods in south King County remain firmly in buyer’s market territory, with MOS also coming in higher than the county aggregate. The Eastside still doesn’t look too good for sellers, with a collective MOS of 7.38, and 6 of 8 areas coming in with MOS above the county as a whole.

Mercer Island took a sudden turn, as new listings flatlined and a few dozen sales cleared out a bit of the standing inventory, pushing MOS way down from last month’s staggering 13.18 all the way into seller’s market territory at 5.10. Vashon dropped as well, but remained well into buyer’s market territory at 9.44 MOS. Bill Gates’ stomping grounds in Area 520 (Medina, Clyde Hill, W. Bellevue) continues to be one of the toughest places to sell, with 13.76 MOS, it earns the distinction of being the only area to exceed 10 MOS for seven months now.

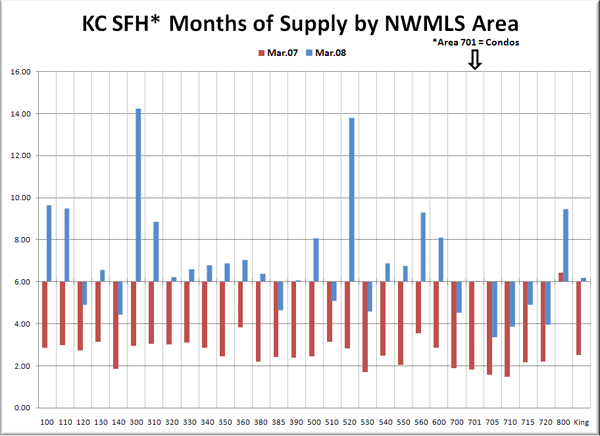

Here’s the bonus graph, which lets you directly compare each area’s MOS to one year ago’s value. March 2007 is in red, and 2008 is in blue.

There is still not a single area that isn’t more of a buyer’s market than this time last year. Again, only one area had less than double last year’s MOS, this time it was area 720 (Lake Forest Park, Kenmore), which increased from 2.21 to 3.95.

The three strongest areas as of last month were Ballard/Greenlake/Greenwood (705) at 3.38, North Seattle (710) at 3.86, and Lake Forest Park/Kenmore (720) at 3.95. Slightly fewer areas were in seller’s market territory last month, just 10 out of 30 areas county-wide came in below 6 MOS. The three weakest areas were Enumclaw (300) at 14.22, Medina/Clyde Hill/W. Bellevue (520) at 13.76, and Jovita/West Hill Auburn (100) at 9.65.