The Washington Center for Real Estate Research posted their latest “Market Snapshot” data (pdf) this week.

Here’s an article on the data from the Times: Home sales still sliding in state, Puget Sound region

WCRER director Glenn Crellin continues to blame the media and buyer fear for the floundering market:

“Buyers see and hear stories about the collapse of the national housing market everywhere, and that makes them afraid to move forward with a purchase,” said Glenn Crellin, center director.

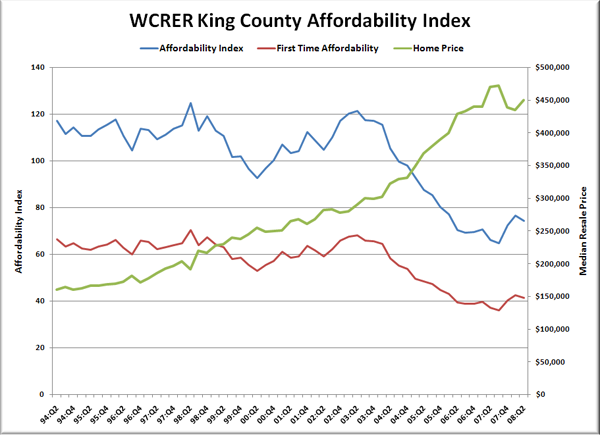

According to the WCRER, King County home prices rose from the first quarter to the second, but are still around 5% below their 3rd Quarter 2007 peak.

The WCRER’s affordability index dropped from 76.6 in Q1 to 74.3 in Q2. The low point for affordability was Q2 2007 at 66.1.

When they post the more detailed data from their Q2 report, it can be found here.

There isn’t really a lot to say about this data, since it’s nothing new to anyone who has been regularly following the monthly data from the NWMLS. Prices had a slight spring bounce, but not enough to put them in the positive YOY. Affordability is still in the gutter.