Let’s have a look at “Months of Supply” for the 30 NWMLS areas in King County. For an explanation of what months of supply means, please refer to the original neighborhood MOS breakdown post. Also, view a map of these areas here.

August MOS for King County came in at 6.80 (compared to 4.92 for August 2007 and 7.21 for September), bringing the current run to a full year (vs. the previous record of 4-5 months in the winter of 1994-1995).

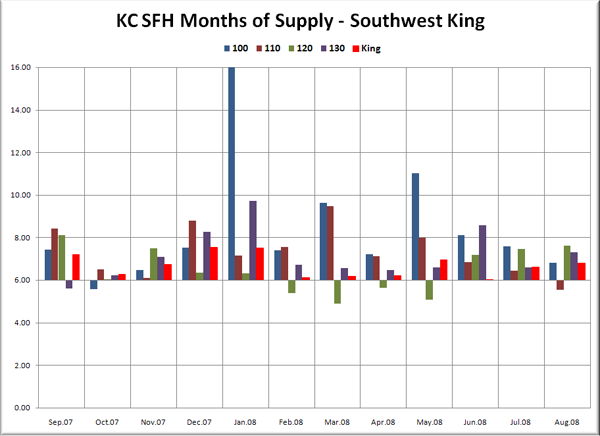

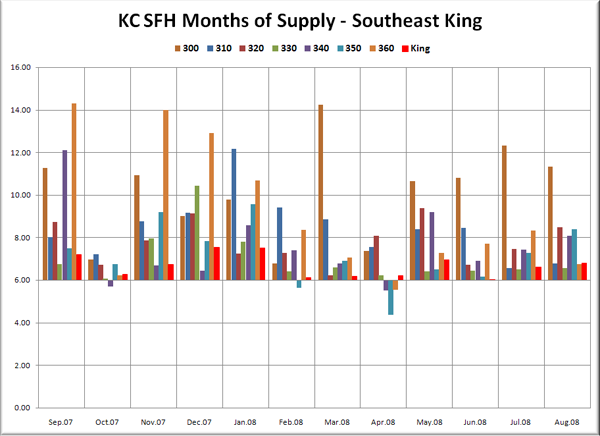

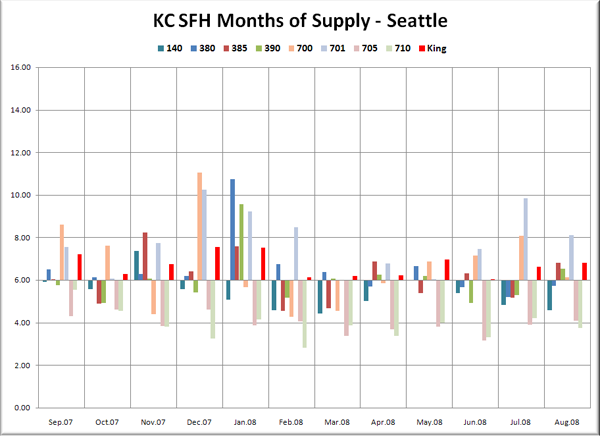

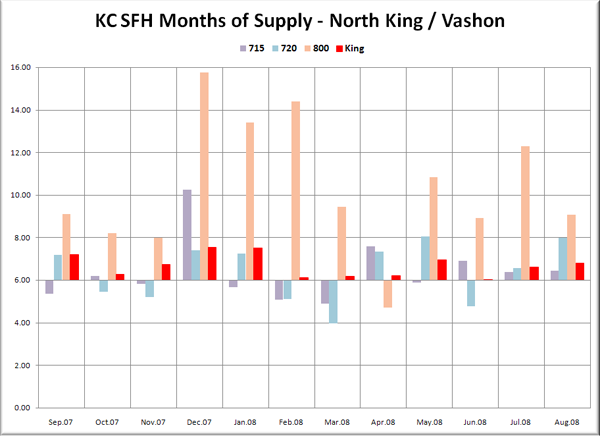

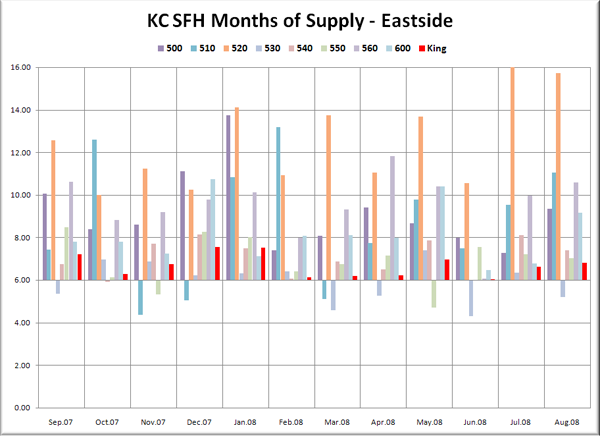

In the graphs below, you’re looking at the MOS for the “Res Only” data from the NWMLS King County Breakout pdfs for the one-year period of September 2007 through August 2008. The bar graph is centered vertically on 6.0 MOS, so that it is easier to visually tell the difference between a seller’s and buyer’s market (i.e. – shorter bars mean a more balanced market). Each graph again has the same scale on the vertical axis and has the King County aggregate figure plotted in red on the far right, so they can be easily compared.

Note: Area 100 MOS was over 21 in January, and has been clipped.

Note: For Area 701 (Downtown Seattle) we’re using condo data.

Note: MOS in area 520 (Medina, W. Bellevue) was over 19 in August, and has been clipped.

A handful of neighborhoods scattered throughout the county were seller’s markets in August. Even in the recently strong city of Seattle, four of eight areas were buyer’s markets in August.

The cumulative MOS for Seattle proper decreased slightly from 5.06 in July to 5.02 in August, up from 3.65 in August 2007. The Eastside as a whole increased to 8.4 MOS, well over August 2007’s 5.2.

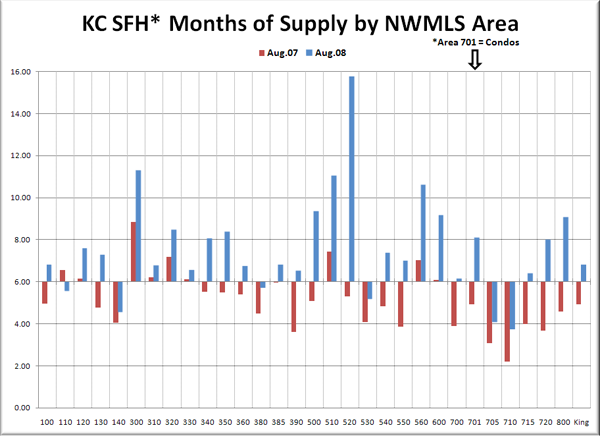

Here’s the bonus graph, which lets you directly compare each area’s MOS to its value one year ago. August 2007 is in red, and 2008 is in blue.

Yet again, even the neighborhoods that remain in “seller’s market” territory were trending more toward a buyer’s market than last year. The single exception is area Dash Point / Federal Way (110), where MOS went from 6.5 last year to 5.6 this year.

The three toughest markets for sellers were Medina / Clyde Hill / W. Bellevue (520) at 15.76, Enumclaw (300) at 11.31, and Mercer Island (510) at 11.06. 520 has now been over 10 MOS for a full year. I guess Bill Gates just isn’t buying property like he used to.

North Seattle neighborhoods continue to hold their title as the strongest markets in which to sell a home. The three best markets for sellers as of last month were the same as last month: North Seattle (710) at 3.74, Ballard/Greenlake/Greenwood (705) at 4.09, and West Seattle (140) at 4.57.