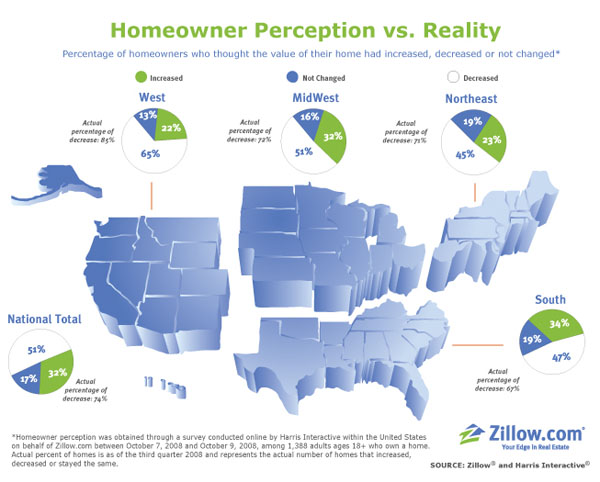

Zillow’s latest Homeowner Confidence Survey is at least worth a brief mention. According to the third quarter update, only 65% of homeowners in the West believe that their home declined in value over the last year, while in reality 85% of homes experienced falling prices. Read Zillow’s own blog post about the report here.

Also interesting is the fact that 39% of those surveyed believed that their own home would decrease in value over the next six months, while 57% of that same survey group believed that the overall value of homes in their local market would decrease. I guess there are a lot of ultra-hyper-micro-local real estate markets out there.

The discontinuity between homeowner perception and reality was not as extreme as it was in last quarter’s report, but it still seems awfully large, especially if you believe (as many in the real estate industry do) that the media has been nothing but “doom and gloom” about the real estate market.