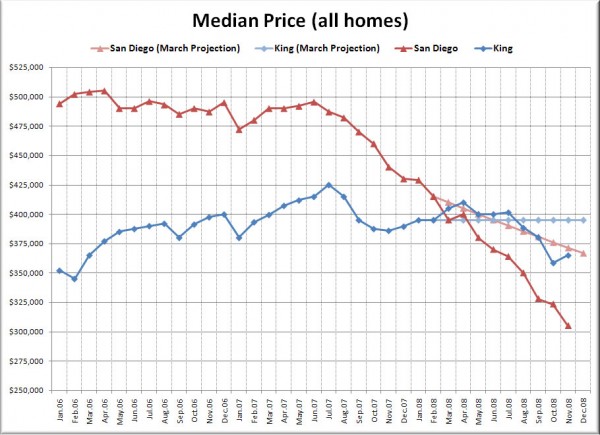

Just for kicks, let’s do an almost end-of-year check on the San Diego County / King County overall median price comparison.

If you recall, back in March San Diego County’s median was at $415,000, while King County’s was at $395,000. Our March “forecast” called for San Diego to fall to $366,771 by the end of the year (a 12% decline), while King held at $415,000, putting San Diego at a 7% discount by year end. Recall that this was based on these two allegedly reasonable assumptions:

- King County home prices will remain flat through December. (Was portrayed as likely by local media.)

- San Diego County home prices will continue to decline, at roughly half the rate they have dropped in the last six months.

Here’s the March forecast compared to the actual median prices recorded for King and San Diego counties:

It looks like our media-based assumptions were too generous for both King and San Diego. In reality San Diego prices have fallen a mind-blowing 27% over the last nine months, while here in King they have dropped 8%. Of course, this means that San Diego County (at $305,000) is currently priced at an even larger discount than the original prediction, with the overall median coming in 16% lower than King County (at $365,000).

It will definitely be interesting to see how long this discount holds. Will homes continue to sell at fire-sale prices in SoCal, while only dropping slightly in the Northwest? Time will tell.