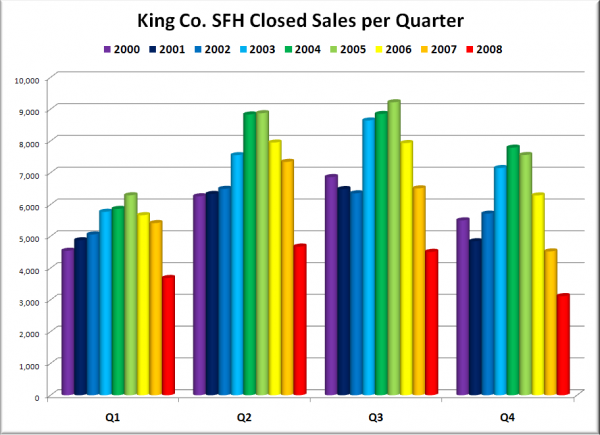

Let’s take a look at 2008’s fourth quarter closed sales volume for King County:

That’s a drop of 31% from 2007, and also 31% from the previous quarter. The “usual” drop from Q3 to Q4 is 10-20%. At this point, I really don’t think sales have much further to drop. They’re practically as low as they can go.

I think we’ll start to see sales pick up this year, if we start to see sellers get realistic with their pricing. If not, we’ll probably stay here in the gutter throughout 2009.

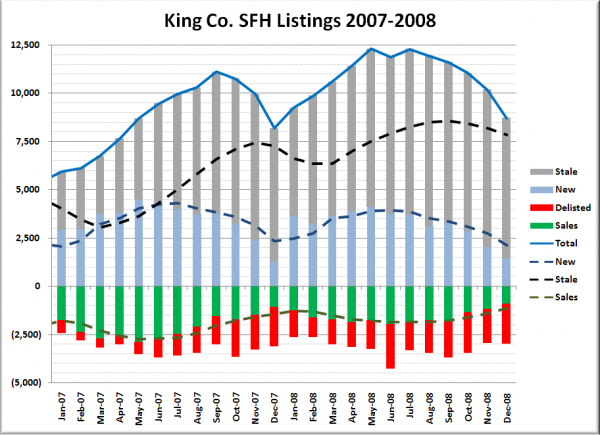

Also, here’s an update to the listings / sales breakdown chart for King County SFH. For a full explanation of the data below, refer to this post. Be sure to check out the delisting tag for previous posts on this subject.

The year-to-year change in delistings stayed in the single digits for all of the fourth quarter, signaling that the delisting situation seems to have reached a plateau. Hopefully this is an indication that wishy-washy sellers with unrealistic dream prices are no longer bothering to put their homes on the market.