We’ve been hearing a lot of speculation recently that goes something along these lines:

There is basically this enormous teeming horde of potential home buyers out there lurking on the sidelines for no good reason. All we need to do is come up with the right concoction of incentives to get these pent-up buyers off the fence and the housing market will recover!

Here’s just one example of that kind of reasoning from an article yesterday’s Tacoma News Tribune:

According to Dick Beeson, a Windermere broker and a director of Northwest MLS, the latest numbers reflect “a lot of pent-up demand. A lot more people are realizing closed sales.”

As regular readers of these pages will recall, I do not buy the claim that there is a large mass of “pent-up demand.” In fact, I believe quite the opposite is true: that during the bubble (thanks to virtually non-existant lending standards and a mass get-rich-quick hysteria) and now post-bubble (thanks to various bailouts, tax incentives, and artificially low interest rates) a significant amount of demand has been borrowed from the future.

Let’s take a few moments to visualize the concept of borrowed demand using data on closed sales and population. Here are our working assumptions:

- The number of closed sales in the year 2000 is a reasonable baseline for a healthy market.

- In a normal market, closed sales will grow linearly as a function of households.

- Household size since the 2000 Census has remained steady at 2.39 people per household.

- For 2009, fourth quarter closed sales will come in 10% above 2008.

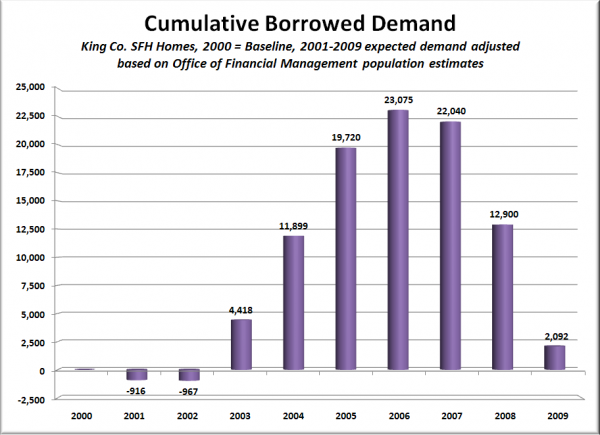

Based on these assumptions, here’s a view of the cumulative “borrowed demand” by year since 2000.

While sales in 2001 and 2002 were fairly close to what our assumptions would have predicted (slightly lower, probably due to the dot-com bubble fallout), as the housing bubble began to inflate in 2003 the number of borrowed sales started to pile up at an alarming pace, peaking at over 23,000 in 2006.

Since 2005 when closed sales peaked at 31,939 (vs. a forecast “normal” level of 24,118), the number of closed sales has dropped significantly, falling to roughly half the peak level in 2008 at 15,991. To real estate agents, these declining sales numbers indicate that there must be a building volume of “pent-up demand.” However, as the chart above demonstrates, this is merely what it looks like when the market is forced to pay back the demand that was borrowed from the future.

If sales had been allowed to continue correcting at the natural rate we were seeing in the first few months of the year, the entire borrowed demand debt would likely have been paid in full in 2009, allowing sales volumes to begin to recover to a more normal level in 2010. Instead, the market has been innundated with misguided attempts to bring out the non-existant “pent-up demand,” and the way things are shaping up right now it looks like last-ditch borrowing of future demand will leave us with a few thousand sales still to be paid back sometime in the future, likely resulting in a continued drag on demand in 2010 and 2011.

“Pent-up demand” is a myth. That’s not to say that there aren’t some legitimate potential buyers out there with the ability to purchase who are sitting on the sidelines waiting for a better market opportunity. However, they are most certainly far outnumbered by the buyers who purchased prematurely in 2003-2006 that would otherwise have waited a few years to buy once their finances were more in order.