Now that October is behind us, let’s have a look at the monthly stats preview. Most of the charts below are based on broad county-wide data that is available through a simple search of King County Records. If you have additional stats you’d like to see in the “preview,” drop a line in the comments and I’ll see what I can do.

Here’s your preview of October’s foreclosure and home sale stats:

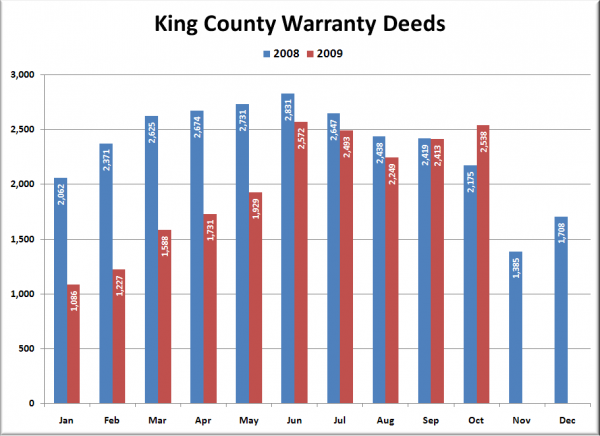

First up, total home sales as measured by the number of “Warranty Deeds” filed with the county:

County sales as measured by warranty deeds were up significantly (16.7%) from last year in October, and marked another month-to-month increase (5.2%). This is no surprise, since as I mentioned last month, the impending expiration of the $8,000 mortgage subsidy is definitely having an effect on the people who have been duped into thinking we have already hit bottom.

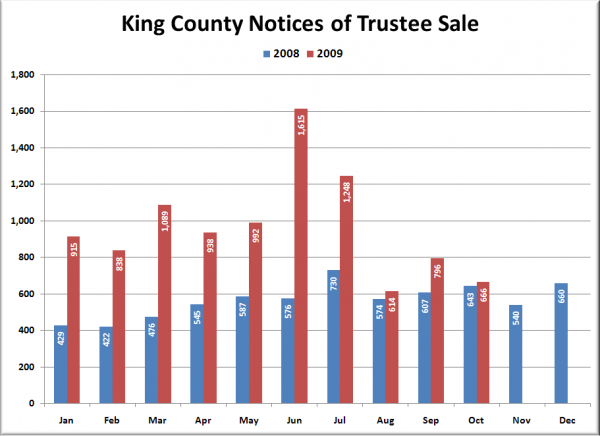

Next, here’s Notices of Trustee sale, which are an indication of the number of homes currently in the foreclosure process:

Foreclosure notices actually declined from September, which could signal either an easing in the foreclosure “crisis” or possibly just a continued lag as the pipeline from SB 5810 continues to fill. We probably won’t really know for sure which one it is until sometime next year.

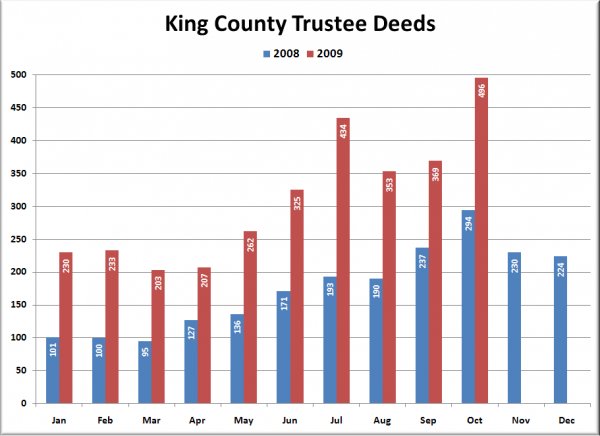

Here’s another measure of foreclosures, looking at Trustee Deeds, which is the type of document filed with the county when the bank actually repossesses a house through the trustee auction process. Note that there are other ways for the bank to repossess a house that result in different documents being filed, such as when a borrower “turns in the keys” and files a “Deed in Lieu of Foreclosure.”

A new record high in October, lagging the peak month for Trustee Sale notices by four months.

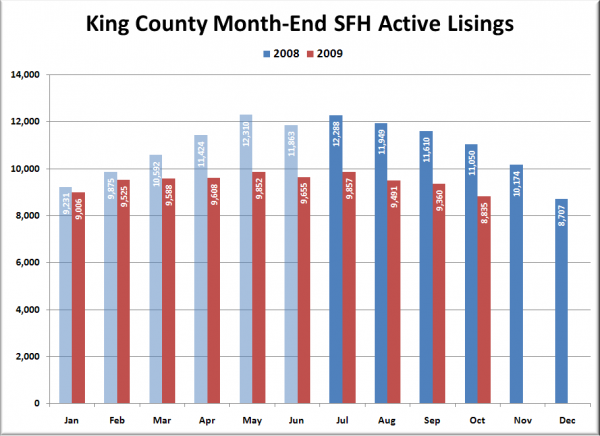

Lastly, here’s an approximate guess at where the month-end inventory was, based on our sidebar inventory tracker (powered by Estately):

Looks like listings will be down around 13% year-over-year, and 6% month-to-month.

Stay tuned later this month a for more detailed look at each of these metrics as the “official” data is released from various sources.