Time for the monthly reporting roundup, where I read all the local paper rehashes of the NWMLS press release so you don’t have to.

Here’s a link to this month’s NWMLS press release: Tax credit spurs big surge in Western Washington home sales

Before we get into the roundup, I’d like to take a moment to quote an excerpt from the monthly NWMLS data post from May, which was titled Huge Gap Opening Between Pending and Closed Sales (a subject that I first brought to your attention in August of last year).

The disconnect between pending sales and closed sales grows ever larger. … Something is becoming extremely fishy about the pending sales data.

…it is good to keep in mind when you start reading news reports in the coming weeks about the market supposedly picking back up. It’s an illusion.

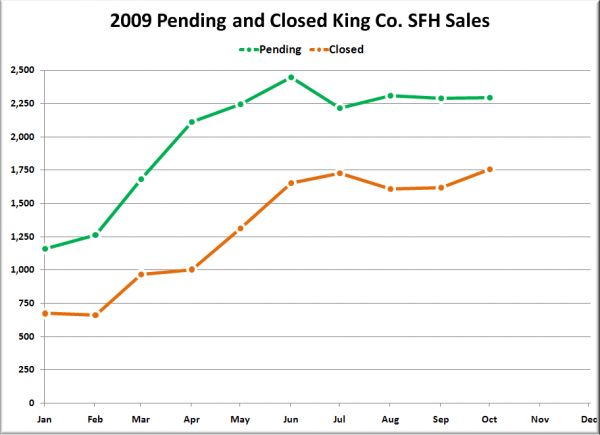

Here’s a graphical representation of the 2009 sales illusion:

Pending sales peaked at 2,447 in June, while so far closed sales have not made it higher than 1,758—a nearly 30% discrepancy. So far this year there have been at total of 20,025 pending SFH sales in King County, but only 12,986 actual closed sales. In other words, more than a third (35%) of pending sales have yet to materialize into closed sales. That difference is typically well under 10%.

Find me a newspaper that reported this growing issue last August.

Click below for this month’s roundup of gawking at the tax credit.

Eric Pryne, Seattle Times: Tax credit brings house buyers out in October in King, Snohomish counties

Home sales in the Seattle area reached new highs for the year in October, a burst real-estate professionals attributed in large part to the $8,000 federal tax credit for first-time buyers.

…

On the Eastside, the tax credit has helped spur sales in neighborhoods south of Interstate 90, said Thadine Bak, broker in Windermere’s Bellevue South office.It also has created what she called “trickle-up” buyers: Homeowners looking for new, often more expensive homes once they sell their houses to first-timers. There has been a burst of interest recently in houses in South Bellevue in the $600,000-$700,000 price range, Bak said.

Eastside sales increased partly because sellers are getting more realistic in pricing their homes, said Mona Spencer, broker in John L. Scott’s Redmond office: “They’re finally getting it.”

But the impact of the federal tax credit can’t be understated, she added: “It gives [buyers] an incentive to go out and look.”

Once again, Eric’s reporting does a good job of sticking to the facts. Home sales are up thanks to the tax credit.

Gerry Spratt, Seattle P-I: Pending home sales spike, MLS report says

Pending homes sales were up more than 64 percent in Seattle and almost 71 percent in King County in October over the same period a year ago as first-time homebuyers rushed to beat the Nov. 30 expiration of an $8,000 federal tax credit, according to the latest numbers released by the Northwest Multiple Listing Service.

In the entire 19-county MLS coverage area, pending sales were up nearly 63 percent year-over-year and the median home price was down 7.2 percent to $269,995 — the smallest drop since June 2008. Inventory fell 17.39 percent from last year to 38,159 — the lowest level since December 2008.

Glenn Crellin, director of the Washington Center for Real Estate Research at Washington State University said the pending sales number is good indicator of market activity, but can be misleading.

“We need to understand that some, and perhaps many, of those pending will never close, and if they are pendings on short-sale properties they may close, but not for a long time,” Crellin said in an e-mail. “That said, the surge in pending sales in October was clearly driven by buyers claiming the tax credit who wanted to be able to close by the end of November. It’s probably even more spectacular than it looks, because I suspect that most of those contracts were written in the first half of the month, giving the buyers at least 45 days to close.”

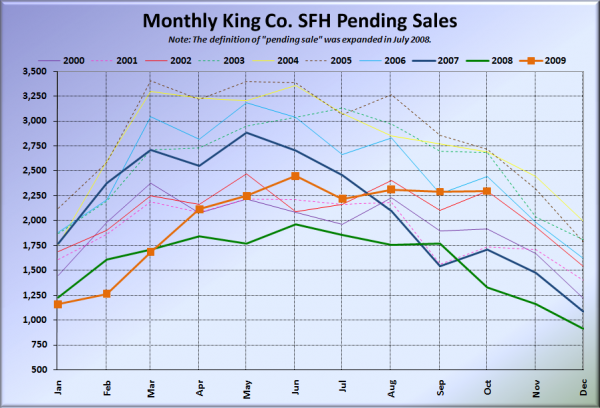

Okay, first off, there was no “surge in pending sales in October.” Pending sales were virtually flat for the month. They “surged” year-over-year because typically pending sales tend to decline slightly from September to October, and last year they dropped off dramatically:

Secondly, as mentioned above, pending sales are about as useful a measure of actual market action these days as “open house traffic.”

Mike Benbow, Everett Herald: Snohomish County home sales shoot up 35%

Home sales in Snohomish County exploded last month as buyers rushed to beat a deadline that they thought might end an $8,000 tax credit.

Home sales in the county rose 35 percent from a year ago and pending sales ballooned 91 percent as first-time buyers hurried to close their deals by the end of this month, the Northwest Multiple Listing Service reported Thursday.

“I had my best month in 20 months,” said Meribeth Hutchings, a Windermere broker in Lake Stevens who is also on the board of the listing service.

She added that Thursday’s House vote to extend the first-time buyer credit and expand it to other people was great news.

It’s always “great news” when the federal government blows tens of billions of dollars that we don’t have to boost your special little industry. Maybe I can get Congress to pass a giant handout to bloggers, next.

Kelly Kearsley, Tacoma News Tribune: Closed sales of homes rise in Pierce County

Pending and closed home sales increased significantly in Pierce County last month as first-time homebuyers scrambled to take advantage of a tax credit that was set to expire this month, according to Northwest Multiple Listing Service figures released Thursday.

Pierce County’s pending home sales – where an offer has been accepted – spiked 55 percent from the same time last year to 1,174. It’s not the most pending sales in a month for this year, but it’s a significant uptick from last October.

…

The threat of an expiring tax credit did create some urgency for buyers who wanted to get a deal closed before the end of November, said Kevin Mullin, incoming president of the Tacoma-Pierce County Association of Realtors.“It’s first-time homebuyers, definitely. They are still making up the lion’s share of the market,” Mullin said.

…

The national real estate industry pushed to expand and extend the housing tax credit. Locally real estate professionals hoped it would help spur more sales.“It can’t hurt anything,” said Larry Bergstrom, president of Crescent Realty in Spanaway.

Well hell, if “it can’t hurt anything,” I still say we should bump it up to $1 million, and make it permanent. Start lobbying your senators and representatives now.

Rolf Boone, The Olympian: Home sales, median prices decline

Thurston County’s median home price fell more than 11 percent from October 2008 to October 2009, the second time this year that prices in the county have dropped by more than 10 percent, according to Northwest Multiple Listing Service data released Thursday.

…

Burger Professionals owner and broker Doug Burger said median prices fell because of the number of houses going through foreclosure or the short-sale process. A short-sale occurs when the lender agrees to accept less for the house than the value of the mortgage. It is that downward pressure on prices that has forced some sellers who are not in default to also lower their prices, Burger said.“The average Joe had to compete with these prices,” he said.

How sad for the average Joe seller. Funny how I don’t recall reading this kind of pity for the average Joe buyer back in the days of bidding wars and waived inspections.

(Eric Pryne, Seattle Times, 11.05.2009)

(Eric Pryne, Seattle Times, 11.06.2009)

(Gerry Spratt, Seattle P-I, 11.05.2009)

(Mike Benbow, Everett Herald, 11.06.2009)

(Kelly Kearsley, Tacoma News Tribune, 11.06.2009)

(Rolf Boone, Olympian, 11.06.2009)