Let’s have a look at the latest data from the Case-Shiller Home Price Index. According to October data,

Up 0.2% September to October.

Up 0.4% September to October (seasonally adjusted)

Down 12.4% YOY.

Down 22.4% from the July 2007 peak

Last year prices fell 1.4% from September to October (not seasonally adjusted) and year-over-year prices were down 10.2%.

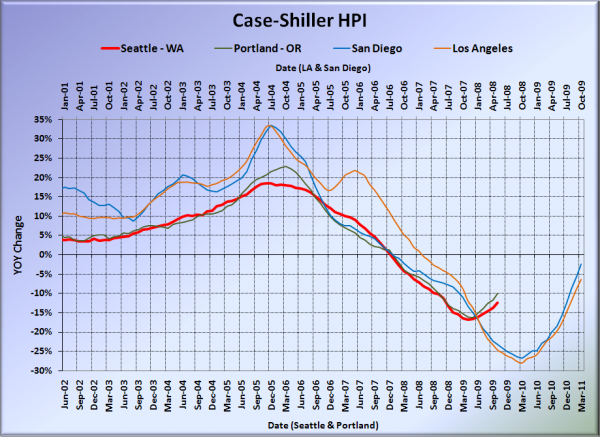

Here’s our offset graph, with L.A. & San Diego time-shifted from Seattle & Portland by 17 months. SoCal’s year-over-year is still shooting up toward zero. Portland came in at -9.9%, Los Angeles at -6.3%, and San Diego at -2.4%, all better than Seattle.

Note: This graph is not intended to be predictive. It is for entertainment purposes only.

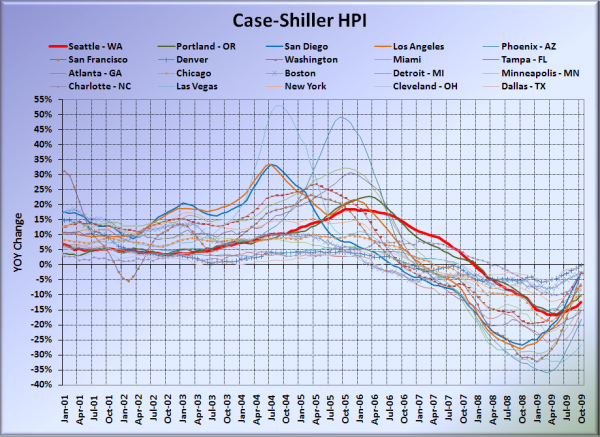

Here’s the graph of all twenty Case-Shiller-tracked cities:

In September, fourteen of the twenty Case-Shiller-tracked cities experienced smaller year-over-year drops than Seattle (same as August and September). Denver at -0.1%, Dallas at -0.6%, San Diego at -2.4%, San Francisco at -2.6, Washington, DC at -2.8%, Boston at -2.8%, Cleveland at -3.5%, Los Angeles at -6.3%, Charlotte at -7.0%, New York at -7.7%, Atlanta at -8.1%, Minneapolis at -8.4%, Portland at -9.9%, and Chicago at -10.1%. Vegas still holds the #1 spot for the largest year-over-year drop, falling 26.6% in the year.

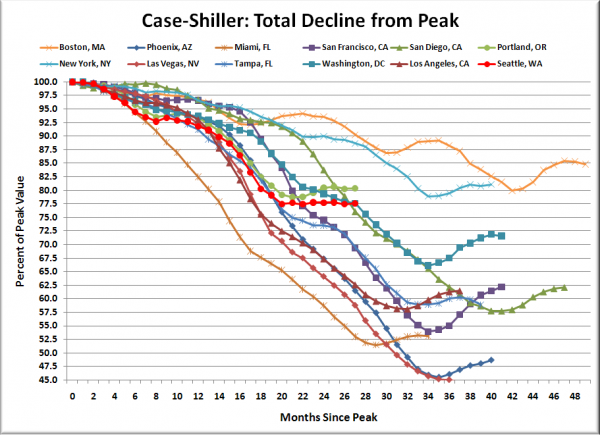

Here’s an update to the peak-decline graph, inspired by a graph created by reader CrystalBall. This chart takes the twelve cities whose peak index was greater than 175, and tracks how far they have fallen so far from their peak. The horizontal axis shows the total number of months since each individual city peaked.

In the twenty-six months since the price peak in Seattle prices have declined 22.4%.

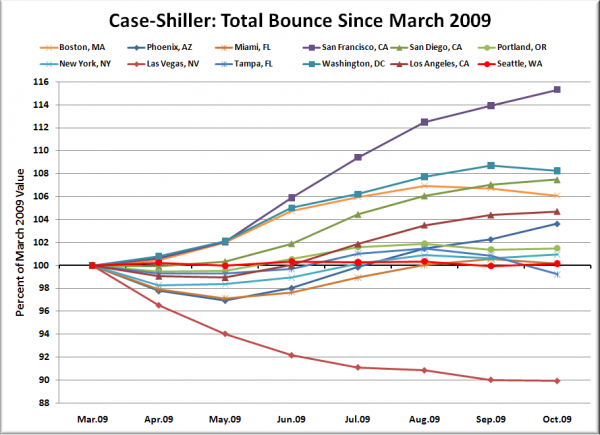

Here’s a complementary chart to that last one. This one shows the total change in the index since March for the same twelve markets as the peak decline chart.

Back above 100 slightly at 100.15, which is higher than March, May, and September’s readings, but lower than June through August. Basically this summer has been the summer of incredibly flat home prices in Seattle. I guess anybody who came to “regret their decision to delay buying a home” from last fall to early this year got to spend the whole summer wallowing in their regret. Or something.

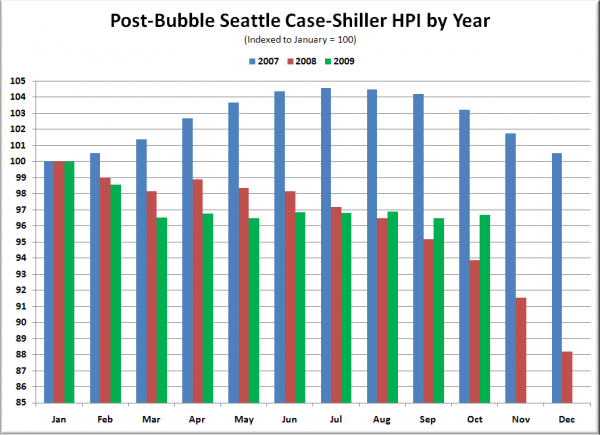

The following chart takes the post-bubble years of 2007, 2008, and 2009 and indexes each January’s Case-Shiller HPI to 100 so we can get a picture of how this year’s declines compare to last year:

It definitely looks as though the tax credit demand seems to have held out Seattle’s spring price plateau for much longer than last year. It will be interesting to see if the effect continues beyond next month, when the giveaway was originally set to expire.

Check back tomorrow for a post on the Case-Shiller data for Seattle’s price tiers.

(Home Price Indices, Standard & Poor’s, 12.29.2009)