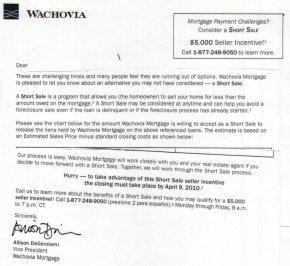

Received this via email from an industry insider. It’s a letter from Wachovia Mortgage offering a $5,000 cash incentive to the a (presumably underwater) mortgage holder if they complete a short sale within 60 days. Click either image to enlarge.

Quoting in part:

These are challenging times and many people feel they are running out of options. Whachovia Mortgage is pleased to let you know about an alternative you may not have considered — a Short Sale.

…

Call us to learn more about the benefits of a Short Sale and how you may qualify for a $5,000 seller incentive!

Considering all the stories about banks taking forever to respond or simply not responding at all to short sale offers made by potential buyers, this seems like an odd tactic.

Has anyone else seen this with any other banks? Are the banks beginning to approach short sales differently than they have been over the past year?

Hat Tip: Ray Pepper, 500 Realty