I was playing around with the sales data I’ve downloaded since April of last year when I noticed a noteworthy trend in the sales of new construction. If you split each month’s sales into new construction and re-sales, then look at the median prices of each group separately, an interesting pattern emerges.

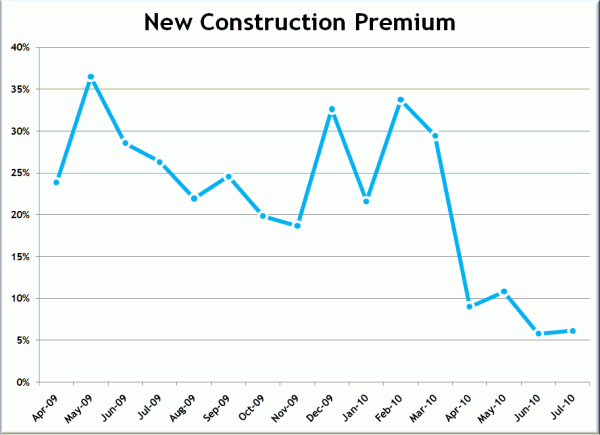

What I’ve plotted below is each month’s new construction median sale price divided by the re-sale median, minus one. The resulting “new construction premium” expresses how much more homebuyers are paying each month for new construction than re-sales.

For the 12-month period between April 2009 and March 2010, new construction was selling for about 20% more than re-sales, but beginning in April of this year, that difference shrank dramatically, falling to as little as 6% in July.

With a swing that large, I’m inclined to question whether my data is correct or not, but with four months in a row telling the same story, I think there may be something real going on here. Unfortunately my data only covers King County, so I am unable to easily see if this is a widespread trend, or just something brought on by one or two big developers slashing prices.

My working theory right now is that this shrinking new construction premium is the result of a couple of factors. I think part of it may be that some builders rapidly adjusting their strategies to succeed in the still-depressed housing market. The other scenario that I think is in play here is builders that bought bank-owned land on the cheap from banks and are taking advantage of low materials and labor costs to put out a noticably less expensive product.

Whatever the cause may be, it is definitely an interesting trend to keep an eye on if you’re interested in buying new construction.