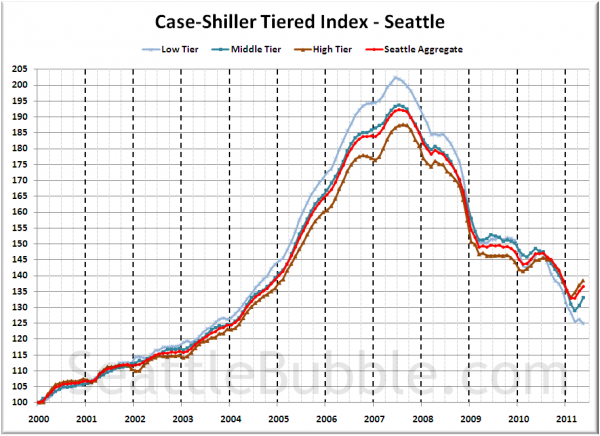

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

Note that the tiers are determined by sale volume. In other words, 1/3 of all sales fall into each tier. For more details on the tier methodologies, hit the full methodology pdf. Here are the current tier breakpoints:

- Low Tier: < $248,198 (up 1.0%)

- Mid Tier: $248,198 – $392,387

- Hi Tier: > $392,387 (up 1.4%)

First up is the straight graph of the index from January 2000 through May 2011.

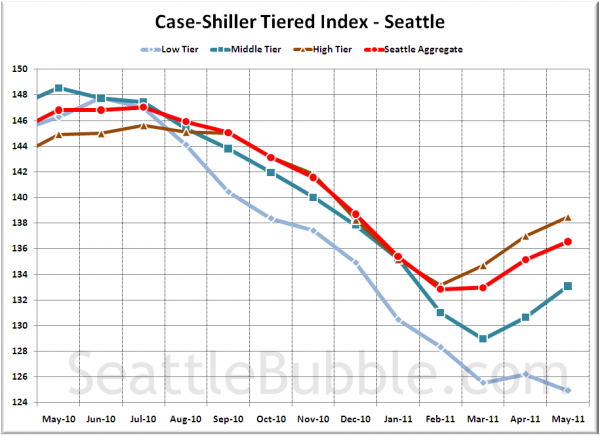

Here’s a zoom-in, showing just the last year:

The low tier flipped around from the weak gains we saw last month, heading back into negative territory for another new post-peak low point. The low tier fell 1.0% MOM, the middle tier bumped up 1.9%, and the high tier gained 1.1%.

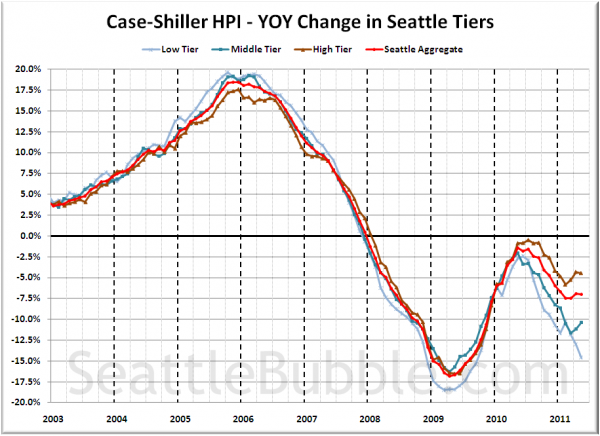

Here’s a chart of the year-over-year change in the index from January 2003 through May 2011.

Only the middle tier rose from last month, thanks to its strong 1.9% MOM bump. Here’s where the tiers sit YOY as of May – Low: -14.6%, Med: -10.4%, Hi: -4.5%.

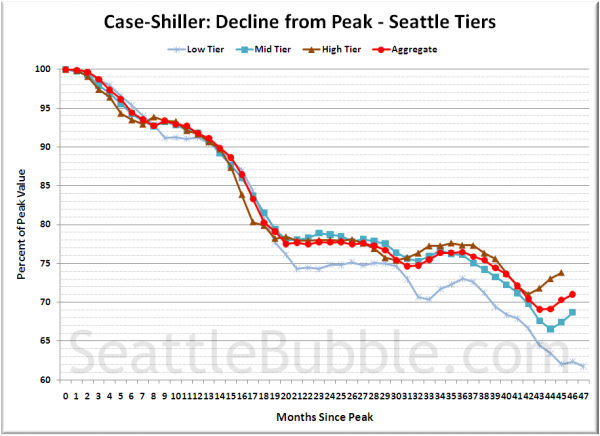

Lastly, here’s a decline-from-peak graph like the one posted yesterday, but looking only at the Seattle tiers.

Current standing is 38.3% off peak for the low tier, 31.3% off peak for the middle tier, and 26.2% off peak for the high tier.

(Home Price Indices, Standard & Poor’s, 07.26.2010)