Let’s have a look at the latest data from the Case-Shiller Home Price Index. According to August data,

Down 0.3% July to August.

Down 6.1% YOY.

Down 28.7% from the July 2007 peak

Last year prices fell 0.8% from July to August and year-over-year prices were down 2.4%.

After increasing for five months in a row from March through July, Seattle’s index dipped a bit this month. I guess the usual spring/summer boost is already wearing off.

Here’s an interactive graph of the year-over-year change for all twenty Case-Shiller-tracked cities, courtesy of Tableau Software (check and un-check the boxes on the right):

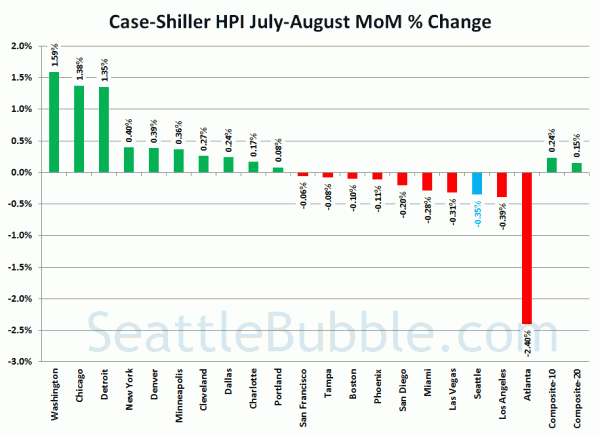

DC and Detroit are the only two cities in YOY positive territory in the latest update. What an odd pair. Meanwhile, after almost every city showed month-to-month gains in July, half are now in negative territory as of August.

Seattle continues to come in near the bottom of the heap in month-over-month changes.

Hit the jump for the rest of our monthly Case-Shiller charts, including the interactive chart of raw index data for all 20 cities.

In August, fifteen of the twenty Case-Shiller-tracked cities experienced smaller year-over-year drops (or saw increases) than Seattle:

- Detroit at +2.7%

- Washington, DC at +0.3%

- Denver at -1.6%

- Boston at -1.7%

- Dallas at -1.9%

- Charlotte at -3.4%

- New York at -3.4%

- Los Angeles at -3.5%

- Miami at -4.6%

- Cleveland at -4.8%

- San Francisco at -5.3%

- San Diego at -5.5%

- Chicago at -5.8%

- Las Vegas at -5.8%

- Tampa at -5.8%

Just four cities were falling faster than Seattle as of August: Atlanta, Portland, Phoenix, and Minneapolis.

Here’s the interactive chart of the raw HPI for all twenty cities through August.

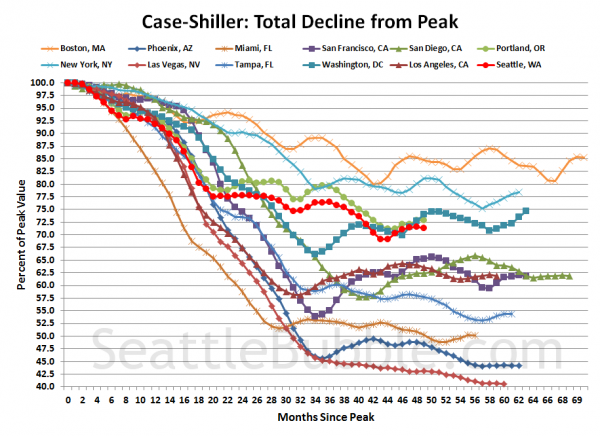

Here’s an update to the peak-decline graph, inspired by a graph created by reader CrystalBall. This chart takes the twelve cities whose peak index was greater than 175, and tracks how far they have fallen so far from their peak. The horizontal axis shows the total number of months since each individual city peaked.

In the forty-nine months since the price peak in Seattle prices have declined 28.5%, the same as last month, up 2.4 points off the low. Four years. What a ride.

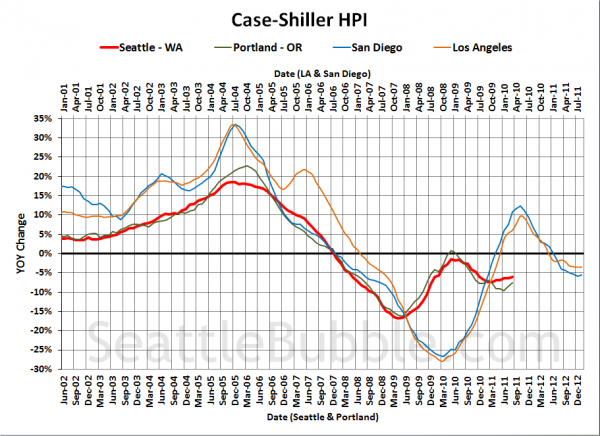

For posterity, here’s our offset graph—the same graph we post every month—with L.A. & San Diego time-shifted from Seattle & Portland by 17 months. Everyone but Los Angeles got a bit of a bump in August. Year-over-year, Portland came in at -7.6%, Los Angeles at -3.5%, and San Diego at -5.5%.

I think this graph is still worth posting if only to display how the government’s massive intervention in the market screwed with the natural flow, causing all the markets to rise simultaneously, and once the artificial support was removed, to come crashing back down to reality simultaneously.

Note: This graph is not intended to be predictive. It is for entertainment purposes only.

Check back tomorrow for a post on the Case-Shiller data for Seattle’s price tiers.

(Home Price Indices, Standard & Poor’s, 10.25.2011)