Behold the sordid tale of a home I’ve been keeping my eye on for quite a while. It’s a spec-built home in Woodinville (just a 37-minute + $3.50 toll drive to downtown Seattle)—7,216 square feet on 14 acres. This one’s got the Avondale Albatross beat by a longshot, both in the sheer audacity of the project and in the scope of the resulting fiasco.

Behold the sordid tale of a home I’ve been keeping my eye on for quite a while. It’s a spec-built home in Woodinville (just a 37-minute + $3.50 toll drive to downtown Seattle)—7,216 square feet on 14 acres. This one’s got the Avondale Albatross beat by a longshot, both in the sheer audacity of the project and in the scope of the resulting fiasco.

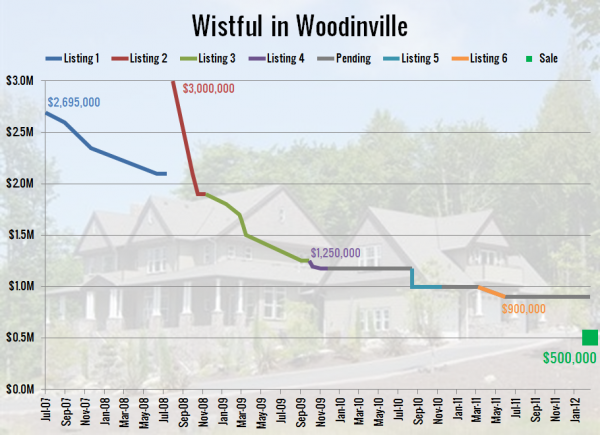

Before I give you the link to the home, have a look at this price history that I compiled by digging through my past email alerts, county records, and personal notes on this home:

- 07/12/2005: Lot purchased for $315,000

- 10/06/2005: Construction loan taken out for $1,200,000

- 02/20/2007: Loan refinanced, boosted to $1,800,000

- 03/06/2007: Additional $350,000 financed, total $2,150,000

- 07/09/2007: Newly-finished home listed at $2,695,000

- 09/07/2007: Price drop to $2,595,000

- 11/27/2007: Price drop to $2,350,000

- 06/20/2008: Price drop to $2,100,000

- 07/20/2008: Delisted

- 08/08/2008: Relisted at $3,000,000 (new listing agent)

- 08/21/2008: Price drop to $2,300,000

- 10/09/2008: Price drop to $2,100,000

- 10/24/2008: Price drop to $1,900,500 – now officially a short sale

- 11/18/2008: Delisted

- 11/18/2008: Relisted at $1,900,500

- 01/22/2009: Price drop to $1,800,500

- 02/11/2009: Price drop to $1,750,000

- 03/03/2009: Price drop to $1,699,995

- 03/10/2009: Price drop to $1,650,000

- 03/23/2009: Price drop to $1,500,000

- 09/11/2009: Price drop to $1,250,000

- 10/06/2009: Delisted

- 10/07/2009: Relisted at $1,250,000

- 10/17/2009: Price drop to $1,195,000

- 11/12/2009: Price drop to $1,175,000

- 12/02/2009: Pending

- 08/23/2010: Back on market

- 08/23/2010: Price drop to $1,000,000

- 11/23/2010: Pending

- 03/16/2011: Back on market

- 06/07/2011: Price drop to $900,000

- 06/15/2011: Pending

- 02/27/2012: Sold for $500,000

For those keeping score at home, that’s 83% off the peak asking price, and 77% off the total amount financed to build it.

Ouch.

Here’s the link: 22325 NE Old Woodinville-Duvall Road, and here’s the data above in chart form:

I’m sure that the surprisingly low final sale price was related to this bit, which appeared in the listing description near the end of its nearly five-year run:

As-Is condition – bank is aware of damage. Please be aware there is mold present.

Nothing like buying a brand new mansion that’s already got mold problems.

I wonder if the Mortgage Forgiveness Debt Relief Act applies to “investment” homes like this. For the builder’s sake, I certainly hope so. Wouldn’t that just be a giant slap in the face to throw away so much money on this beast only to have the IRS subsequently come after you for taxes as if you had earned $1.6 million.

This is easily the biggest flop I’ve seen in the Seattle area during the post-bubble crash. Can anyone else beat an 83% discount off peak list?