When you read a story claiming that a “recovery” is just around the corner for real estate or that the housing market is “recovering,” what does that mean to you?

Some people (mostly people who bought near the peak and real estate agents) think recovery means that home prices and home sales volumes will get back to the peak levels seen between 2005 and 2007. That is of course wishful thinking. The prices and sales volumes we saw during the bubble were ridiculously unsustainable, as documented on these pages during the last few years before the house of cards finally collapsed.

Personally, “recovery” is a loaded word when it comes to real estate. People who think that somehow the market will recover to anything that even remotely resembles the bubble seem to be confused about what “recover” really means.

Here’s Merriam-Webster’s definition of “recover”:

to bring back to normal position or condition

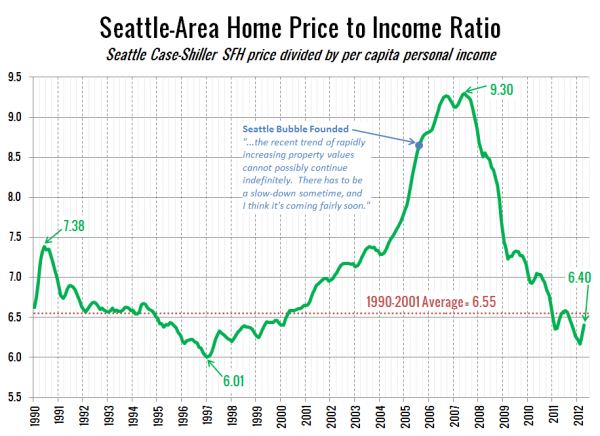

Here is Seattle area’s home price to income ratio over the last 22 years:

It looks to me like the last few years were the recovery. During the housing bubble home prices grew grossly out of whack with local economic fundamentals, but between 2007 and 2011 they have been brought “back to normal condition.”

So what exactly are people expecting out of a future “recovery” in real estate? From what I can tell, it looks like the recovery is nearly complete.