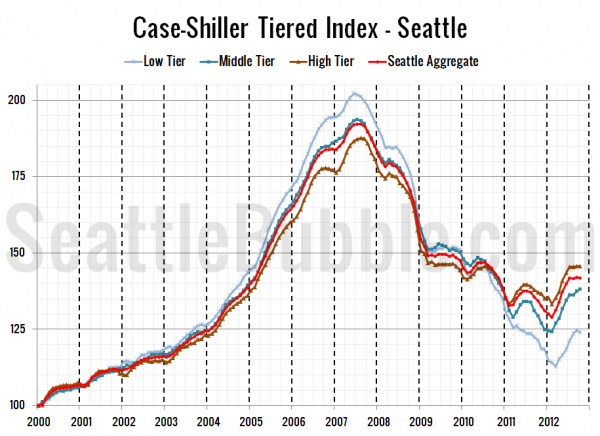

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

Note that the tiers are determined by sale volume. In other words, 1/3 of all sales fall into each tier. For more details on the tier methodologies, hit the full methodology pdf. Here are the current tier breakpoints:

- Low Tier: < $256,900 (down 0.4%)

- Mid Tier: $256,900 – $410,901

- Hi Tier: > $410,901 (down 0.5%)

First up is the straight graph of the index from January 2000 through October 2012.

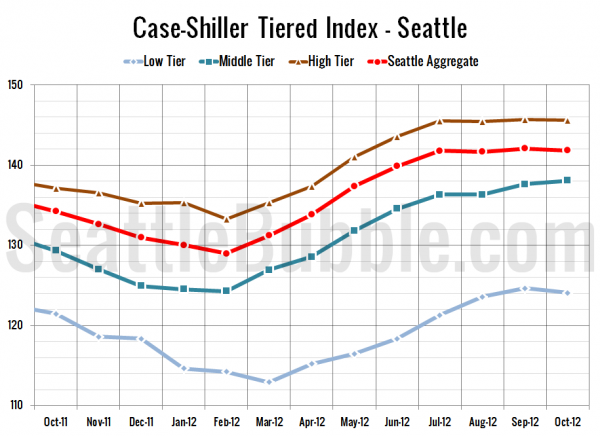

Here’s a zoom-in, showing just the last year:

The high tier and low tier both fell a bit, but the middle tier actually rose again in this month’s data. Between September and October, the low tier fell 0.5%, the middle tier was up 0.3%, and the high tier lost 0.1%.

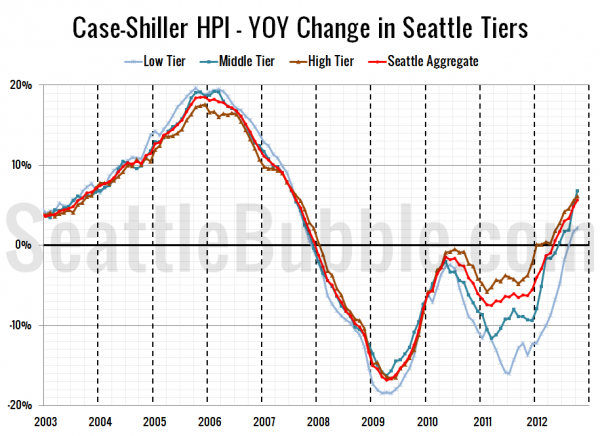

Here’s a chart of the year-over-year change in the index from January 2003 through October 2012.

All three tiers keep improving their year-over-year gains. Here’s where the tiers sit YOY as of October – Low: +2.1%, Med: +6.8%, Hi: +6.1%.

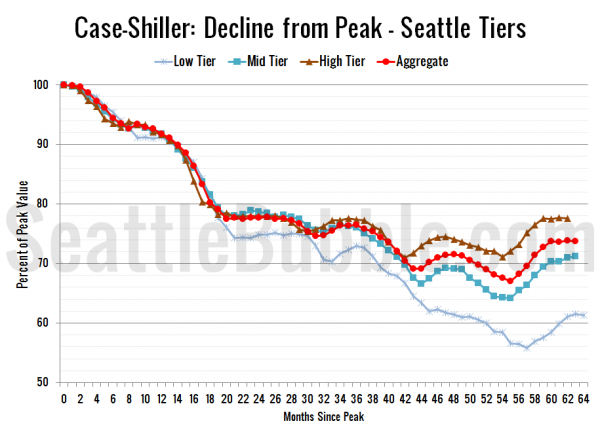

Lastly, here’s a decline-from-peak graph like the one posted yesterday, but looking only at the Seattle tiers.

Current standing is 38.7% off peak for the low tier, 28.7% off peak for the middle tier, and 22.4% off peak for the high tier.

(Home Price Indices, Standard & Poor’s, 12.26.2012)