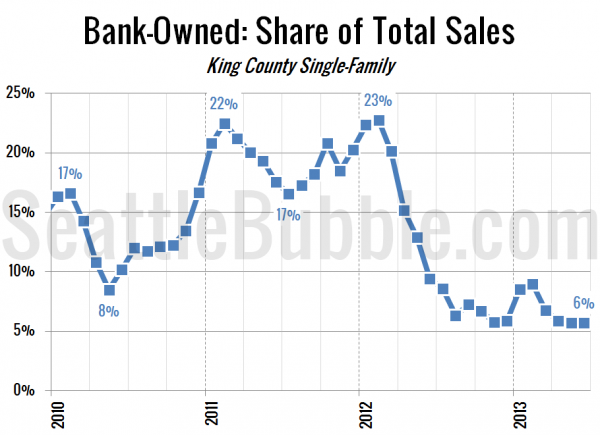

Time to take look at what share of the monthly sales are being distressed sales—bank-owned and short sales. In June 2012 9.4% of the sales of single-family homes in King County were bank-owned. In June 2013 that number was just 5.7%.

We’ve now matched the low of 5.7% set in November.

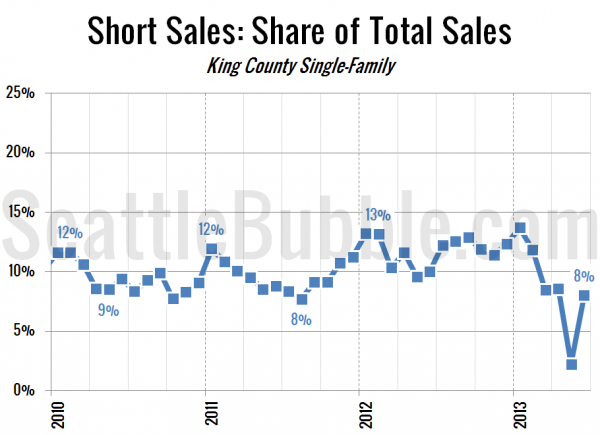

Short sales bounched back from their dramatic tumble last month, rising from 2.2% in May to 8.0% in June. A year ago 10.0% of sales in the county were short sales.

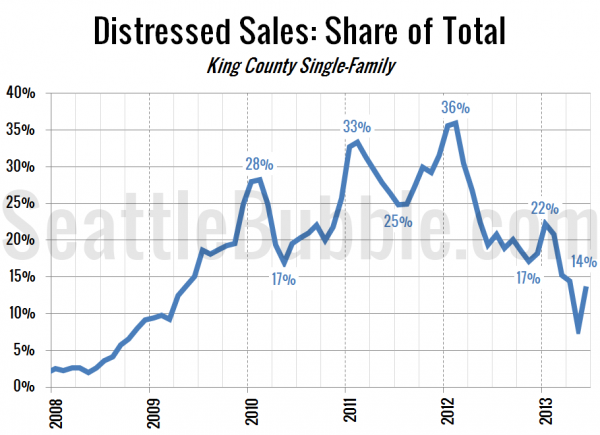

The total percentage of sales that were distressed in May was at 13.7%, matching the level set in May 2009.

Later this week we’ll take a look at how the median prices are moving for bank-owned homes, short sales, and non-distressed sales.