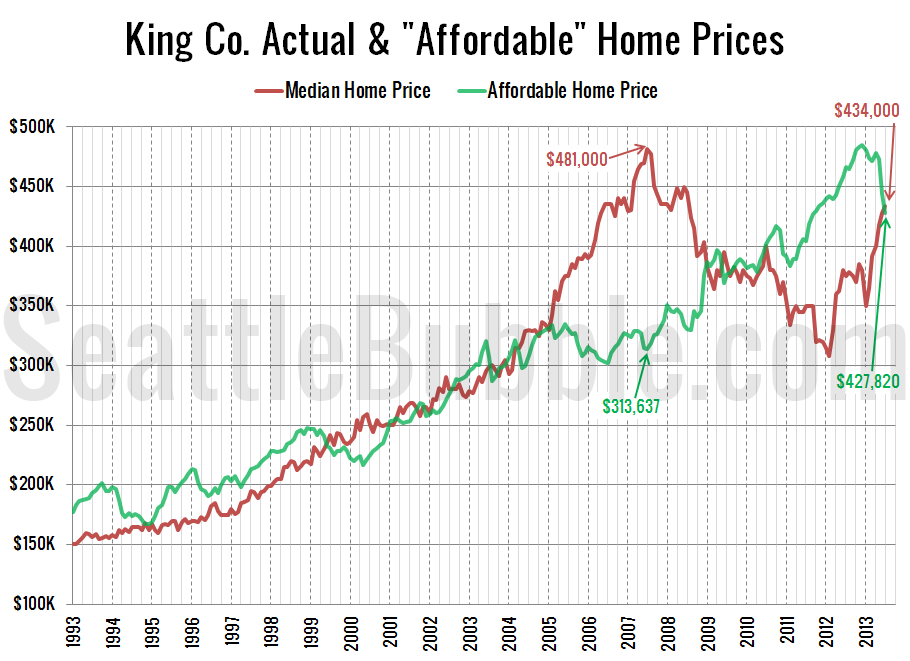

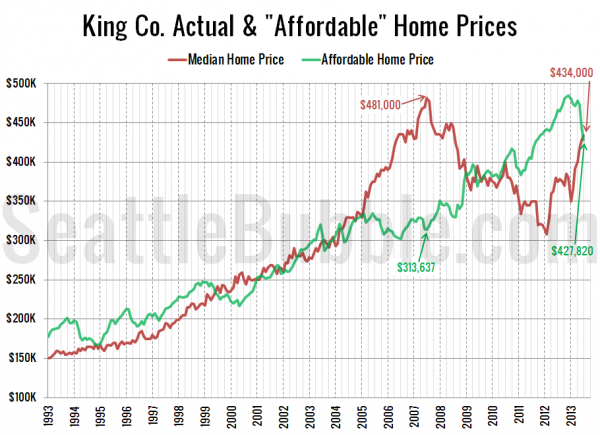

As promised in last week’s affordability post, here’s an updated look at the “affordable home” price chart.

In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could afford to buy at today’s mortgage rates if they put 20% down and spent 30% of their monthly income.

The “affordable” home price has been dropping dramatically this year thanks to the rapid increase in interest rates. The “affordable” home in King County now sits at $427,820, with a monthly payment of $1,708.

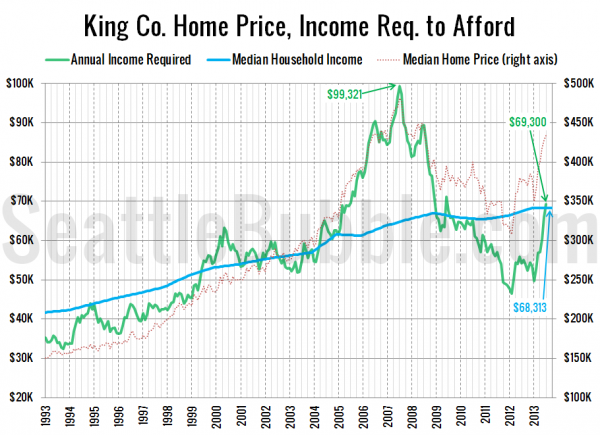

Here’s the alternate view on this data, where I flip the numbers around to calculate the household income required to make the median-priced home affordable at today’s mortgage rates, and compare that to actual median household incomes.

As of July, a household would need to earn $69,300 a year to be able to afford the median-priced $434,000 home in King County (up from just $49,732 in January). Meanwhile, the actual median household income is around $68,000.

If interest rates were 6% (around the pre-bust level), the “affordable” home price would drop down to $356,064—18% below the current median price of $434,000, and the income necessary to buy a median-priced home would be $83,266—22% above the current median income.

At this point if prices keep rising, we’ll be back in serious bubble territory almost immediately. Therefore, I expect home price increases to come to a grinding halt in the second half of 2013.