Let’s have a look at the latest data from the Case-Shiller Home Price Index. According to June data, Seattle-area home prices were:

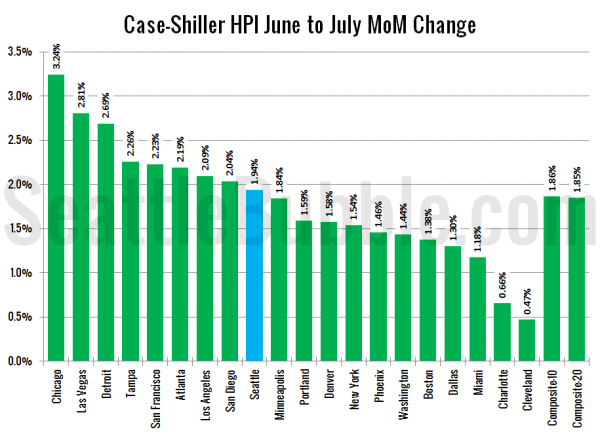

Up 1.9% June to July

Up 12.5% YOY.

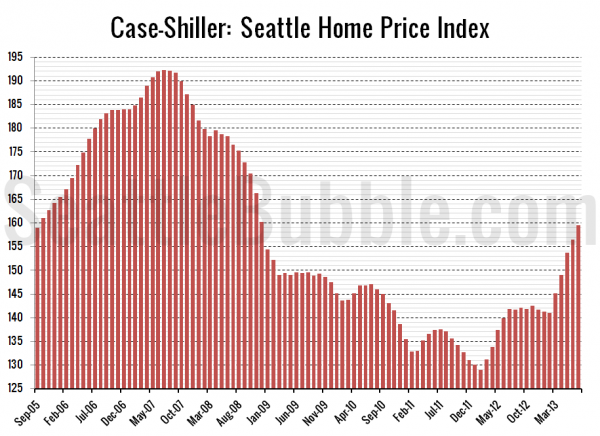

Down 17.1% from the July 2007 peak

Last year prices rose 1.4% from June to July and year-over-year prices were up 3.1%.

After slowing down slightly between May and June, the year-over-year number increased again between June and July.

Here’s an interactive graph of the year-over-year change for all twenty Case-Shiller-tracked cities, courtesy of Tableau Software (check and un-check the boxes on the right):

Seattle’s position for month-over-month changes rose from #14 in June to #9 in July.

Hit the jump for the rest of our monthly Case-Shiller charts, including the interactive chart of raw index data for all 20 cities.

In July, nine of the twenty Case-Shiller-tracked cities gained more year-over-year than Seattle (one more than in June):

- Las Vegas at +27.5%

- San Francisco at +24.8%

- Los Angeles at +20.8%

- San Diego at +20.4%

- Phoenix at +18.9%

- Atlanta at +18.5%

- Detroit at +16.9%

- Miami at +13.7%

- Tampa at +12.6%

Ten cities gained less than Seattle as of July: Portland, Denver, Minneapolis, Dallas, Chicago, Charlotte, Boston, Washington DC, Cleveland, and New York.

Here’s the interactive chart of the raw HPI for all twenty cities through July.

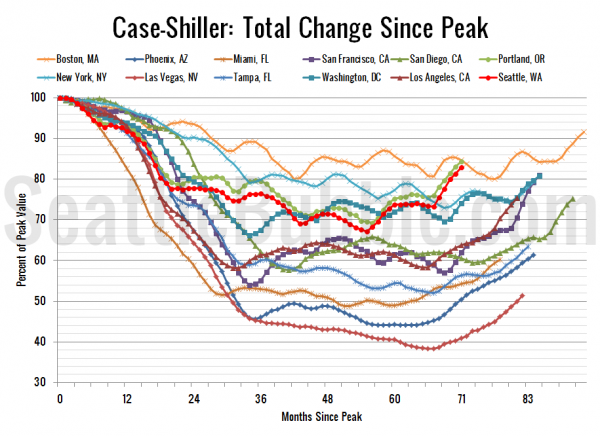

Here’s an update to the peak-decline graph, inspired by a graph created by reader CrystalBall. This chart takes the twelve cities whose peak index was greater than 175, and tracks how far they have fallen so far from their peak. The horizontal axis shows the total number of months since each individual city peaked.

In the seventy-two months since the price peak in Seattle prices have declined 17.1%.

Lastly, let’s see what month in the past Seattle’s current prices most compare to. As of July: September 2005.

Check back tomorrow for a post on the Case-Shiller data for Seattle’s price tiers.

(Home Price Indices, Standard & Poor’s, 08.27.2013)