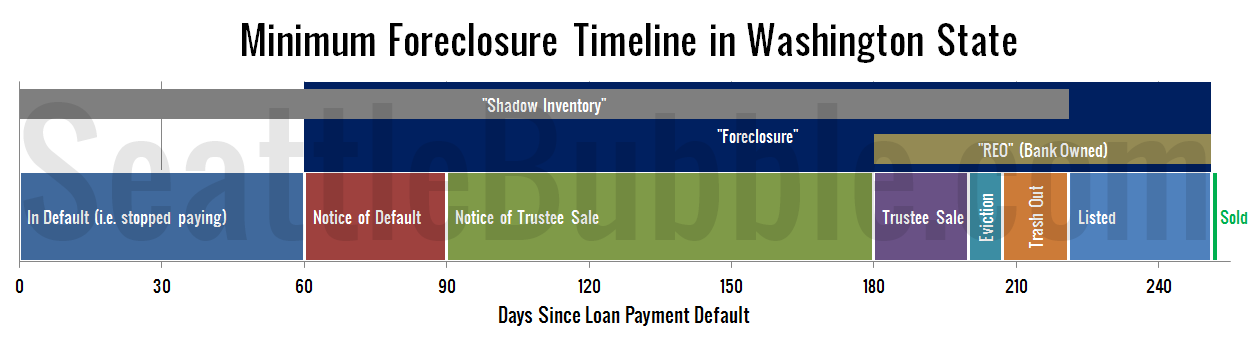

Based on some articles and comments that I have read, it seems that there are a lot of misconceptions about how the foreclosure timeline works. Any time we’re talking about foreclosures it’s important that we understand exactly what the various terms mean, so let’s take a moment to look at the foreclosure timeline in Washington State.

Minimum Foreclosure Timeline in Washington State

To start things off, here’s a visual (click to enlarge):

- Day 0 – Borrower misses first payment

- Day 60 – Borrower receives Notice of Default (not public record in WA)

- Day 90 – Borrower receives Notice of Trustee Sale (public record in WA)

- Day 210 – Trustee Sale: Home is auctioned on the courthouse steps

- Day 230 – Borrower must vacate the home

- Day 237 – Bank begins the “trash out” and clean up process

- Day 251 – Bank lists the home on the MLS

- Day 281+ – Bank sells home

Foreclosure Timeline Terminology

“Foreclosure”

Technically a home has not actually been foreclosed until Day 210 in the process above, but the word “foreclosure” is often used broadly to describe any home at some point in the process between the Notice of Default at Day 60 and whenever the bank sells the home. On Seattle Bubble when we provide stats on the number of foreclosures that are happening in the Seattle metro area we’re referring to homes that have reached the Notice of Trustee Sale stage.

“REO” / “Bank Owned”

Any home that has been sold back to the bank at the courthouse auction (Day 210) and not yet sold to a new buyer is bank owned, also known as real estate owned (REO).

“Shadow Inventory”

In its broadest sense, the term “shadow inventory” can mean any home where the borrower is not current on the loan, but the home is not yet listed on the market for sale. Note that when it is used this broadly, many homes that are considered to be shadow inventory will never end up as normal inventory due to the borrower getting current on their loan or working out a loan modification plan with the bank that holds the mortgage.

It is also worth noting that even in the fastest scenario outlined above, all foreclosed homes that at least get to the notice of trustee sale stage will pass through a period of at least 161 days as “shadow inventory,” even if they are moving along the process at a normal rate. In other words, about five months worth of homes in the foreclosure pipeline would be considered “shadow inventory” at any given time.

Based on the latest Trustee Deed stats for King County that’s a minimum of 1,724 homes in recent months. That sounds like a lot of shadow inventory compared to the ~5,000 homes on the market right now, but it just represents the normal process playing out. The vast majority of so-called “shadow inventory” is made up of homes just moving through the normal foreclosure timeline, not some massive store of homes sitting in some unsold cache, waiting to flood the market any day now.

Ways to Extend and Delay the Foreclosure Timeline

Note that what I have described above is the minimum foreclosure timeline. In Washington state, there are a number of ways to drag it out (some ethical, some not), should a borrower be so inclined.

Notice of Pre-Foreclosure Options

Thirty days before the official Notice of Default, the lender must send the borrower a letter detailing their pre-foreclosure options, as described in RCW 61.24.031. If the borrower responds to the letter asking for a meeting with a representative of the lender, an additional sixty days are added to the process.

The HAMPster Wheel

Some borrowers have taken to abusing the federal government’s Home Affordable Modification Program (HAMP) to drag out the foreclosure process by months or even years. The “HAMPster Wheel” name for this “game” comes from a lengthy thread on the LoanSafe forums in which various borrowers share their tactics for living for free in their mortgaged home for as long as possible.

Filing Bankruptcy

Filing bankruptcy any point before the actual Trustee Sale will delay or even cancel the process, pending the outcome of the bankruptcy. Chapter 13 bankruptcy could cancel the foreclosure completely, while Chapter 7 will generally just delay the process by about 60 days.

Filing a Motion to Restrain Sale

Up until five days before the courthouse steps foreclosure auction, the homeowner may file a motion with the court to restrain the sale. If you have no legal grounds to restrain the sale this delay tactic will not buy you much time, but if there is a valid legal argument (e.g. predatory lending, illegal foreclosure process, MERS issues etc.), the court may approve a restraint of the sale.

Forcing a Sheriff’s Eviction

As early as 20 days after the Trustee Sale, the bank can take possession of the home. However, if the borrower decides not to move out willingly, they can force the bank to evict them. The sheriff’s eviction process can delay the final move out of the house by about two weeks.

[Update: Some corrections and additions were made to this post.]