Let’s check in again on the cheapest homes around Seattle proper. Here’s our methodology: I search the listings for the cheapest homes currently on the market, excluding short sales, in the city of Seattle proper. Any properties that are in obvious states of extreme disrepair based on listing photos and descriptions will be excluded. This includes any listing that uses the phrases “fixer,” “rehab loan,” or “value in land.” I post the top (bottom) three, along with some overall stats on the low end of the market.

Please note: These posts should not be construed to be an advertisement or endorsement of any specific home for sale. We are merely taking a brief snapshot of the market at a given time. Also, just because a home makes it onto the “cheapest” list, that does not indicate that it is a good value.

Here are this month’s three cheapest single-family homes in the city limits of Seattle (according to Redfin):

| Address | Price | Beds | Baths | SqFt | Lot Size | Neighborhood | $ / SqFt | Notes |

|---|---|---|---|---|---|---|---|---|

| 10624 55th Ave S | $159,000 | 3 | 2 | 1,058 | 6,499 sqft | Rainier Valley | $150 | – |

| 4221 S Kenyon St | $165,000 | 2 | 1 | 810 | 4,755 sqft | Rainier Valley | $204 | – |

| 9633 59th Ave S | $178,900 | 2 | 1 | 690 | 4,176 sqft | Rainier Valley | $259 | bank owned |

We skipped last month, but the number one home from June’s post has since sold, the number two home is pending, and number three is still for sale, but was bumped off the “cheapest” list. To find three homes that fit our criteria I had to go all the way up to the $200,000 line. It may be time to retire this series, or adjust our threshold.

Stats snapshot for Seattle Single-Family Homes Under $200,000 (excluding short sales)

Total on market: 12

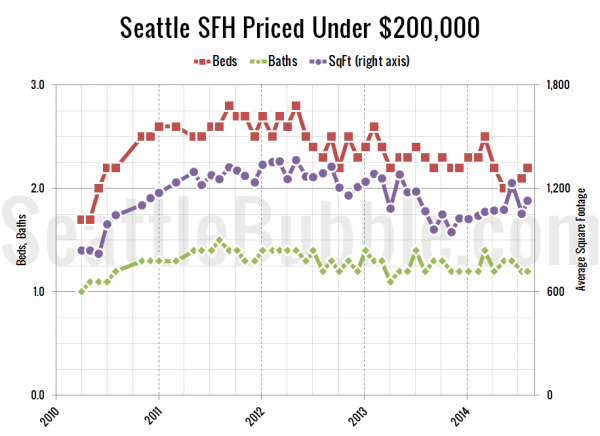

Average number of beds: 2.2

Average number of baths: 1.2

Average square footage: 1,131

Average days on market: 47

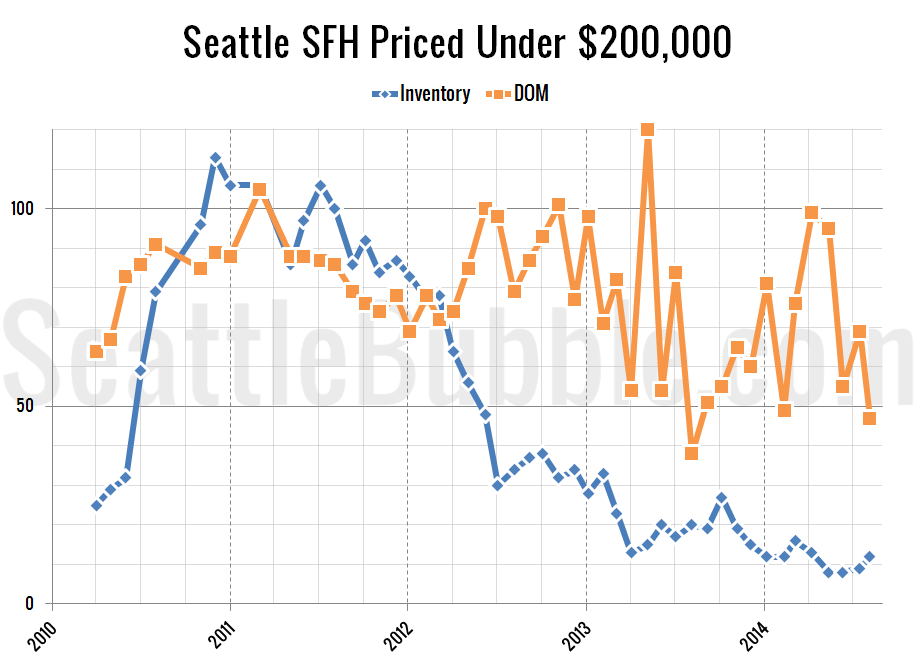

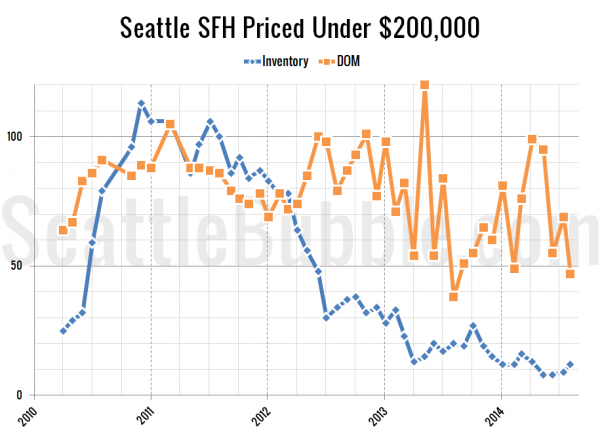

Inventory of non-short sale homes under $200,000 in Seattle inched up slightly in August from the single-digits it had been sitting at for the previous three months. Beds and baths are mostly unchanged, square footage bumped up from July, and days on market fell to its lowest point since last August.

Here are our usual charts to give you a visual of the trend of these numbers since I adjusted the methodology in April 2010:

Here are cheapest homes in Seattle that actually sold in the last month, regardless of condition (since most off-market homes don’t have much info available on their condition).

| Address | Price | Beds | Baths | SqFt | Lot Size | Neighborhood | $ / SqFt | Sold On |

|---|---|---|---|---|---|---|---|---|

| 7764 10th Ave SW | $148,000 | 2 | 1 | 630 | 4,200 sqft | Delridge | $235 | 07/11/2014 |

| 9012 2nd Ave S | $165,000 | 1 | 1.5 | 850 | 8,050 sqft | Beacon Hill | $194 | 07/18/2014 |

| 3010 SW City View St | $165,500 | 0 | 0.75 | 370 | 2,992 sqft | West Seattle | $447 | 07/31/2014 |