It’s time once again to take an updated look at how King County’s sales are shifting between the different regions around the county, since geographic shifts can and do affect the median price.

In order to explore this concept, we break King County down into three regions, based on the NWMLS-defined “areas”:

- low end: South County (areas 100-130 & 300-360)

- mid range: Seattle / North County (areas 140, 380-390, & 700-800)

- high end: Eastside (areas 500-600)

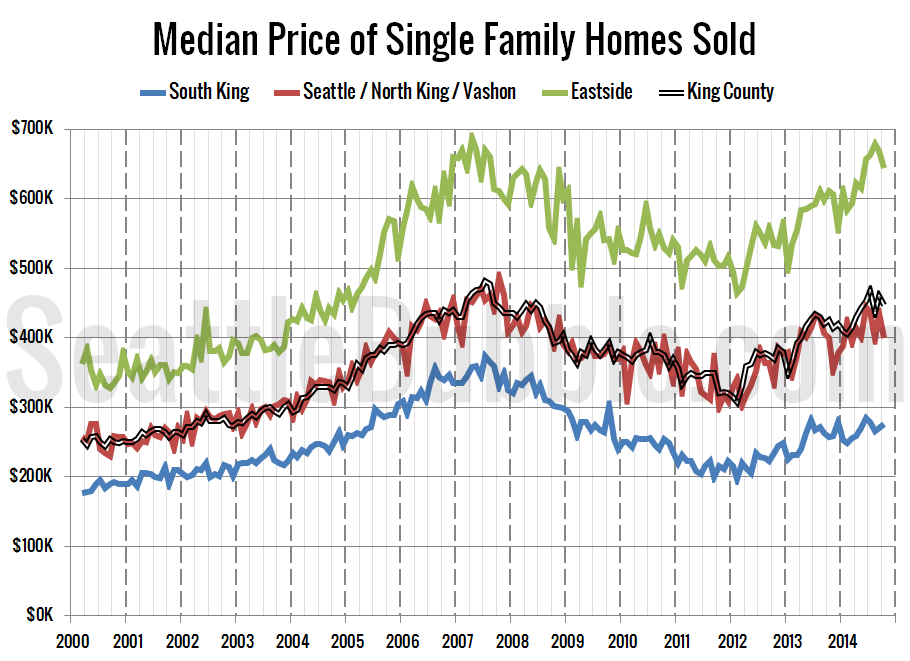

Here’s where each region’s median prices came in as of September data:

- low end: $240,000-$395,000

- mid range: $350,000-$724,500

- high end: $509,000-$1,706,000

First up, let’s have a look at each region’s (approximate) median price (actually the median of the medians for each area within the region).

The median price in the middle and high tiers fell between September and October, but the low tier rose slightly. The low tier rose 2.4 percent in the month, the middle tier decreased 8.2 percent, and the high tier lost 3.7 percent.

Area 520, which includes Bellevue west of I-405, Medina, and Hunts Point, hit an all-time high median price of $1,706,000 on 39 sales—the sales highest volume for that region in over a year.

Twenty-two of the twenty-nine NWMLS regions in King County with single-family home sales in October had a higher median price than a year ago, while just twelve had a month-over-month increase in the median price.

Here’s how the median prices changed year-over-year. Low tier: up 7.6 percent, middle tier: 0.0 percent change, high tier: up 5.5 percent.

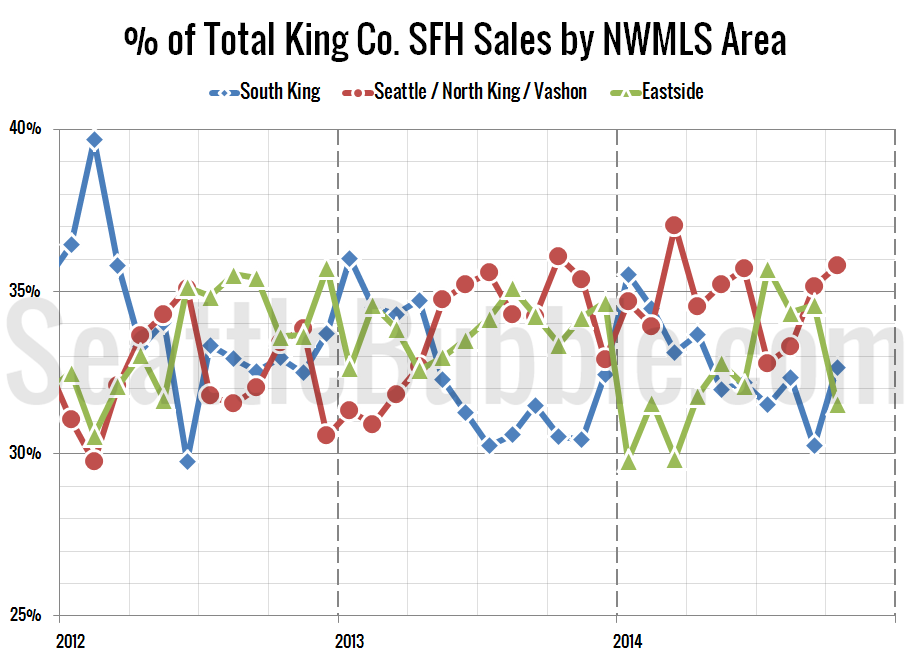

Next up, the percentage of each month’s closed sales that took place in each of the three regions.

The share of sales in the low tier regions of South King County gained ground in October. Seattle gained slightly as well, while Eastside sales dipped. This shift in the geographic sales mix away from the expensive regions and toward the cheaper regions explains much of the month-over-month dip in the county-wide median price.

Year-over-year sales were mixed across the three tiers. Compared to a year ago, sales increased 9.4 percent in the low tier, rose 1.5 percent in the middle tier, and dropped 3.3 percent in the high tier.

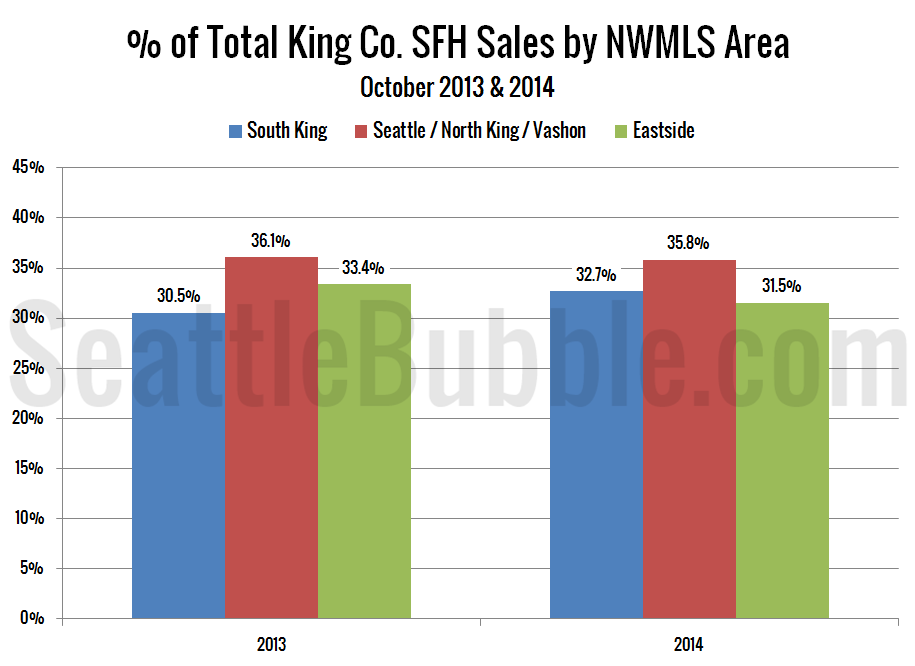

As of October 2014, 32.7 percent of sales were in the low end regions (up from 30.5 percent a year ago), 35.8 percent in the mid range (down from 36.1 percent a year ago), and 31.5 percent in the high end (down from 33.4 percent a year ago).

Here’s that information in a visual format:

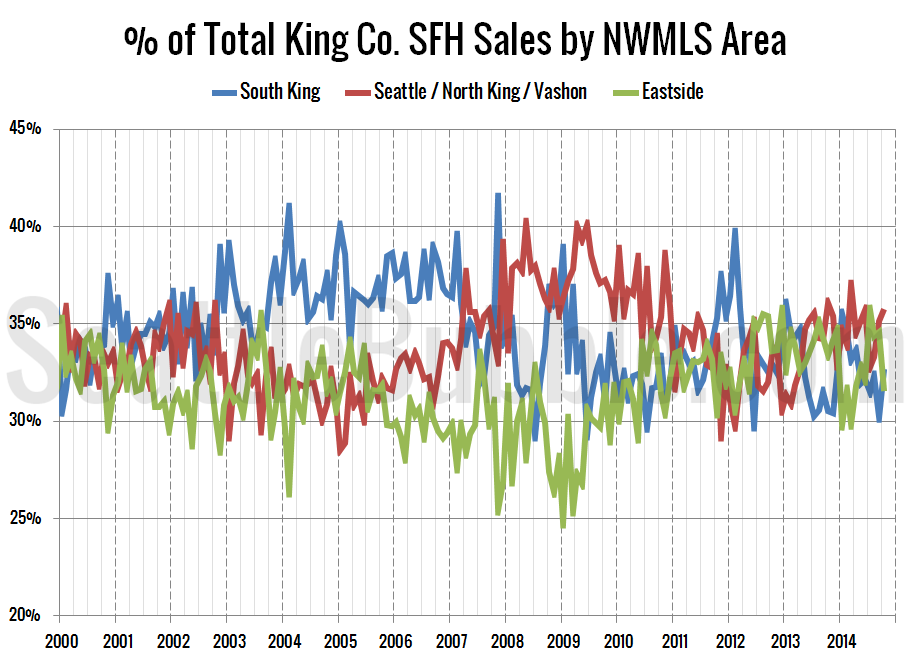

Finally, here’s an updated look at the percentage of sales data all the way back through 2000:

Interesting to see a dip in overall sales on the Eastside as sales in Seattle and South King jumped up quite a bit from September. Most likely all three tiers will see a dip in sales next month.