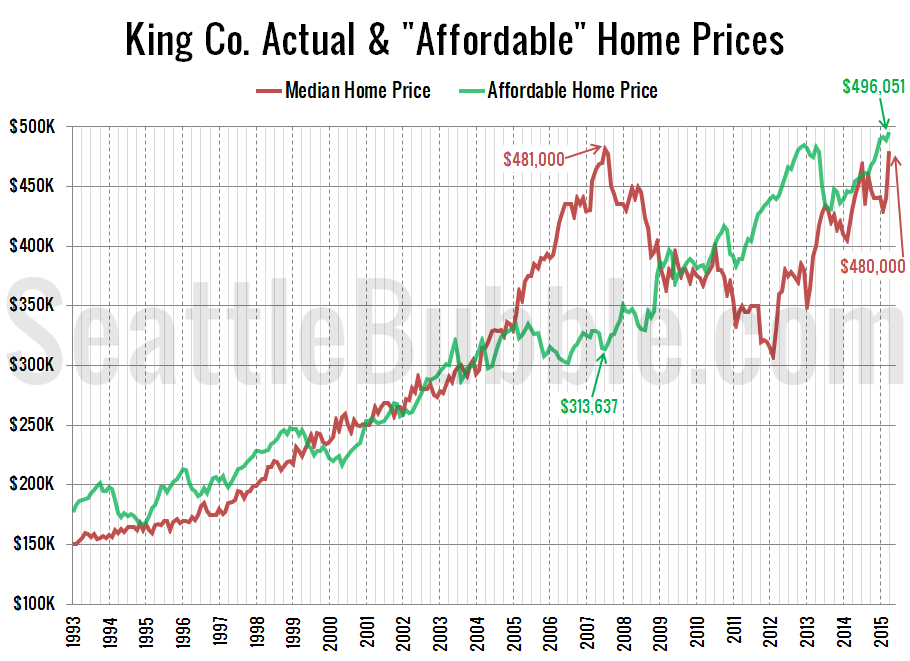

As promised in yesterday’s affordability post, here’s an updated look at the “affordable home” price chart.

In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could afford to buy at today’s mortgage rates if they put 20% down and spent 30% of their monthly income.

The “affordable” home price has made some strong gains recently thanks to the combination of increasing incomes and decreasing mortgage interest rates. The “affordable” home price in King County hit an all-time high of $496,051 in April, with a monthly payment of $1,820.

If interest rates were at a more reasonable level of 6 percent (which is still quite low by historical standards), the “affordable” home price would be just $379,423—about $120,000 lower than it is today.

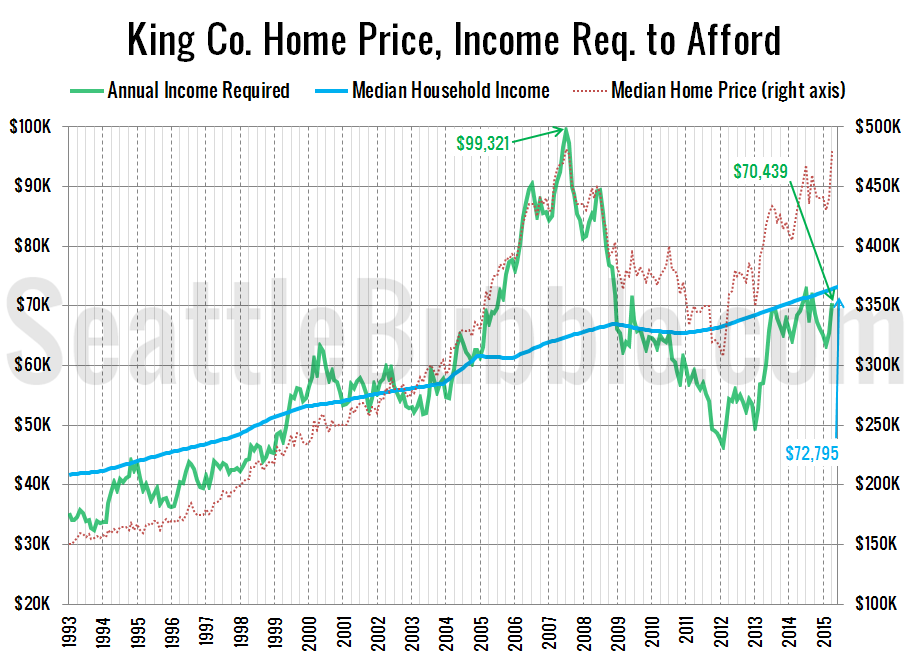

Here’s the alternate view on this data, where I flip the numbers around to calculate the household income required to make the median-priced home affordable at today’s mortgage rates, and compare that to actual median household incomes.

As of April, a household would need to earn $70,439 a year to be able to “afford” the median-priced $480,000 home in King County. This is up from the low of $46,450 in February 2012, but still down slightly from the 2014 high point of $72,625 set in July. Meanwhile, the actual median household income is around $73,000.

If interest rates were 6% (around the pre-bust level), the income necessary to buy a median-priced home would be $92,091—27 percent above the current median income.

In other words (and I realize I sound like a broken record on this), ridiculously low rates are basically the only thing allowing home prices to be as ridiculously high as they are today.