Let’s have a look at the latest data from the Case-Shiller Home Price Index. According to August data that was released today, Seattle-area home prices were:

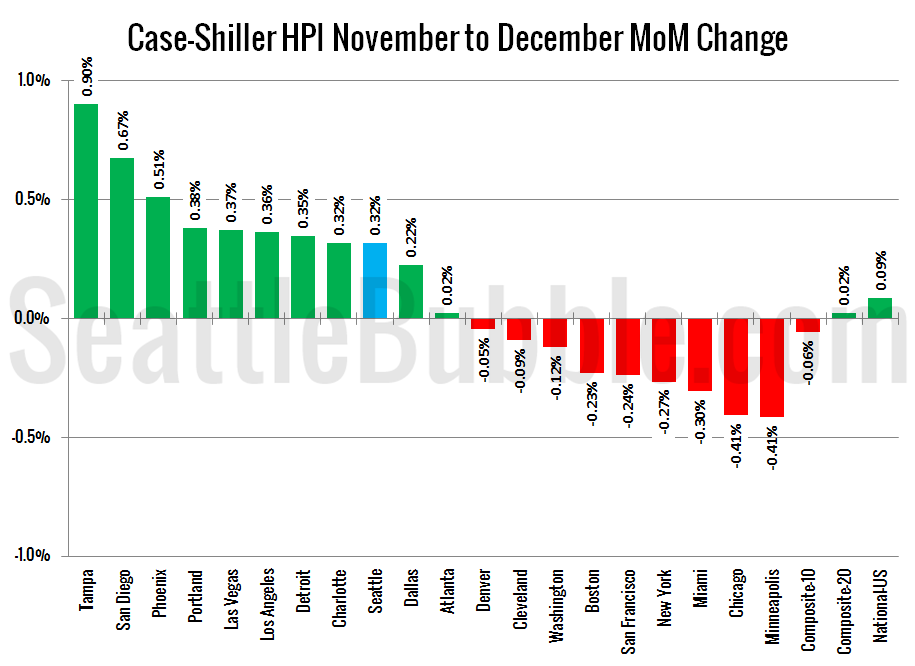

Up 0.3 percent November to December

Up 9.9 percent YOY.

Down 2.9 percent from the July 2007 peak

Over the same period in 2014 prices were up 0.1 percent month-over-month and year-over-year prices were up 6.5 percent.

The Seattle area’s month-over-month home price change was positive in December, but not quite as high as it was in November. The year-over-year price change is inching back up almost into double digits, as well. The only possible sign of relief for home buyers is that the increase in year-over-year price gains is slowing just slightly.

Here’s a Tableau Public interactive graph of the year-over-year change for all twenty Case-Shiller-tracked cities. Check and un-check the boxes on the right to modify which cities are showing:

Seattle’s rank for month-over-month changes fell from #3 in November to #9 in December.

Hit the jump for the rest of our monthly Case-Shiller charts, including the interactive chart of raw index data for all 20 cities.

In December, just three of the twenty Case-Shiller-tracked cities gained more year-over-year than Seattle (one fewer than in October):

- Portland at +11.4%

- San Francisco at +10.3%

- Denver at +10.2%

Portland, and Dallas both hit new all-time highs in December.

Sixteen cities gained less than Seattle as of December: Dallas, San Diego, Miami, Detroit, Tampa, Phoenix, Los Angeles, Las Vegas, Atlanta, Charlotte, Minneapolis, Boston, New York, Cleveland, Chicago, and Washington.

Here’s the interactive chart of the raw HPI for all twenty cities through December.

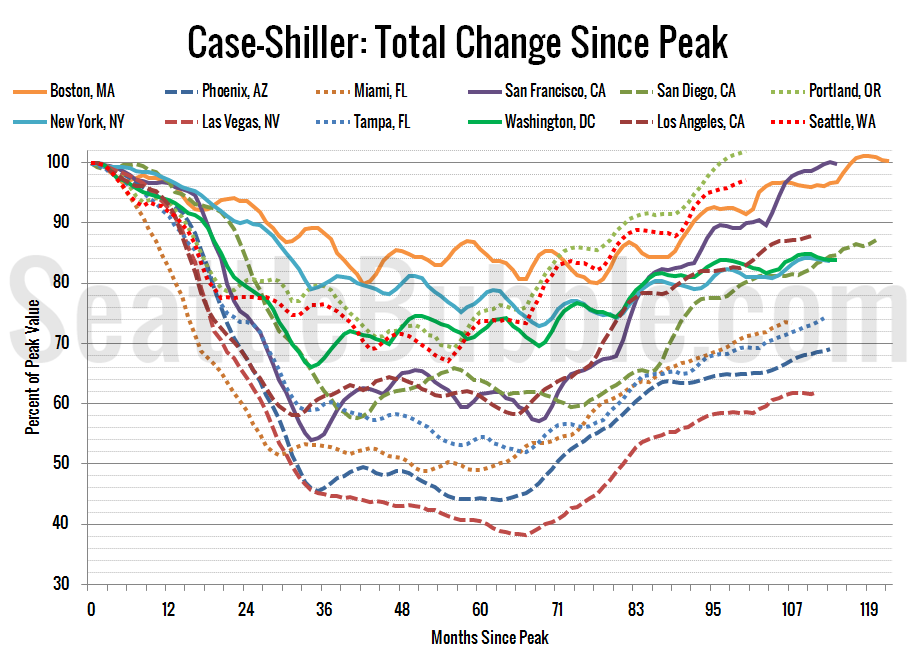

Here’s an update to the peak-decline graph, inspired by a graph created by reader CrystalBall. This chart takes the twelve cities whose peak index was greater than 175, and tracks how far they have fallen so far from their peak. The horizontal axis shows the total number of months since each individual city peaked.

In the 101 months since the price peak in Seattle prices are down 2.9 percent.

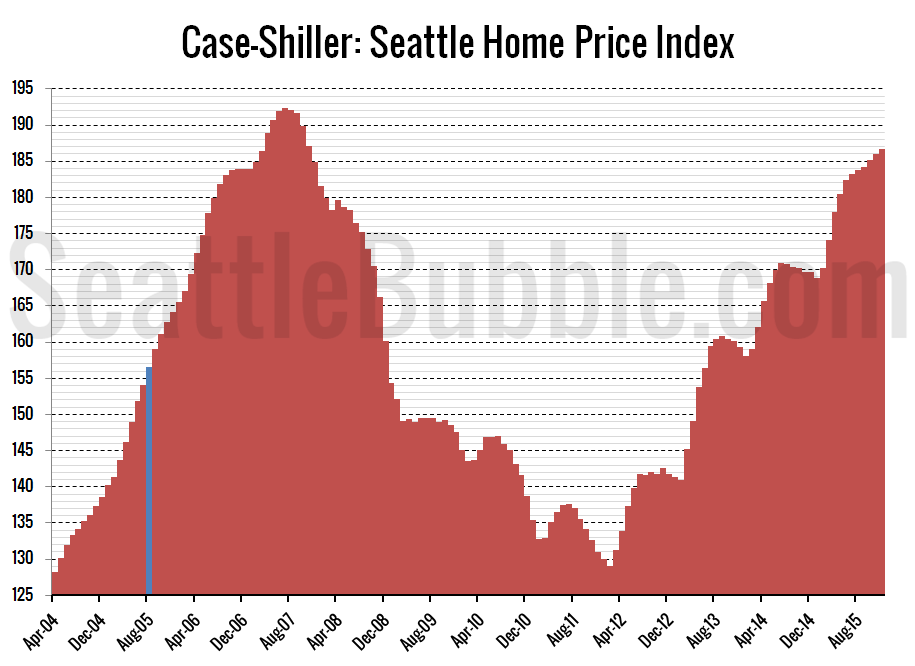

Lastly, let’s see what month in the past Seattle’s current prices most compare to. As of December 2015, Seattle prices are approximately where they were in March 2007.

Check back tomorrow for our monthly look at Case-Shiller data for Seattle’s price tiers.

(Home Price Indices, Standard & Poor’s, 2016-02-23)