Let’s have a look at the latest data from the Case-Shiller Home Price Index. According to February data that was released this morning, Seattle-area home prices were:

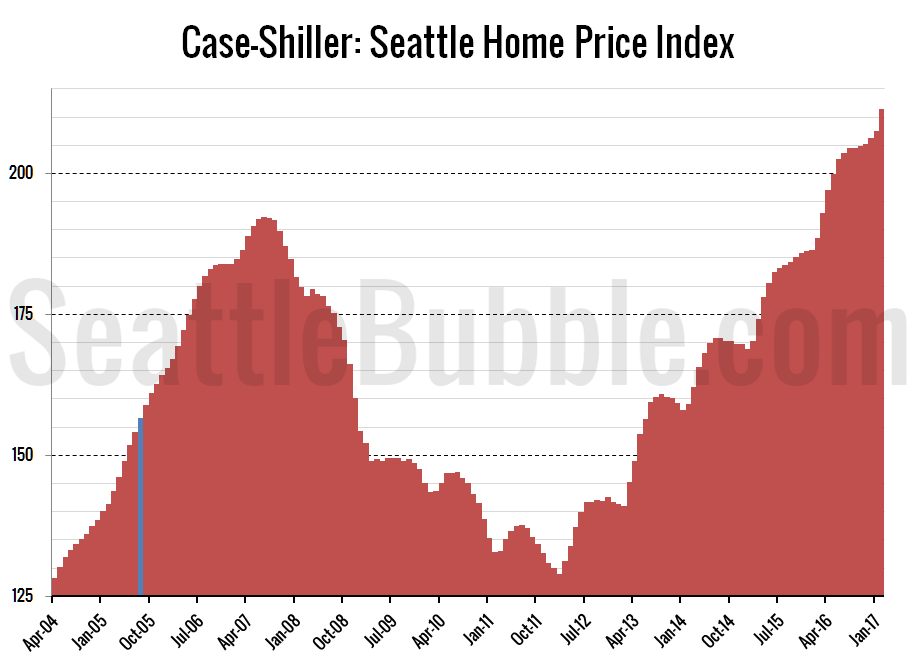

Up 1.9 percent January to February

Up 12.2 percent year-over-year.

Up 10.0 percent from the July 2007 peak

Over the same period a year earlier prices were up 1.1 percent month-over-month and year-over-year prices were up 10.7 percent.

Seattle home prices as measured by Case-Shiller shot up yet again to a new all-time high in February.

Here’s a Tableau Public interactive graph of the year-over-year change for all twenty Case-Shiller-tracked cities. Check and un-check the boxes on the right to modify which cities are showing:

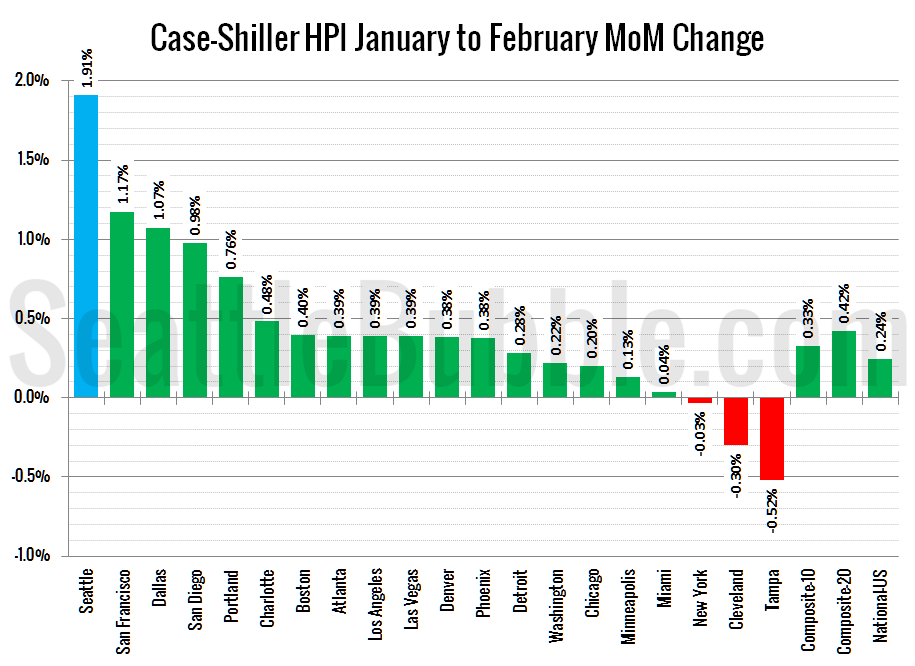

Seattle’s rank for month-over-month changes jumped up from #3 in January to a strong #1 in February.

Hit the jump for the rest of our monthly Case-Shiller charts, including the interactive chart of raw index data for all 20 metro areas.

Seattle’s year-over-year price growth edged up once again from January to February, hitting its highest point since February 2014. Yet again in February, none of the twenty Case-Shiller-tracked metro areas gained more year-over-year than Seattle. From February through August of last year, Portland had been in the #1 slot above Seattle.

Don’t worry, the Northwest will always and forever continue to be literally the envy of other states.

Seven cities hit new all-time highs again in February: San Francisco, Denver, Boston, Charlotte, Portland, Dallas, and Seattle.

Here’s the interactive chart of the raw HPI for all twenty metro areas through February.

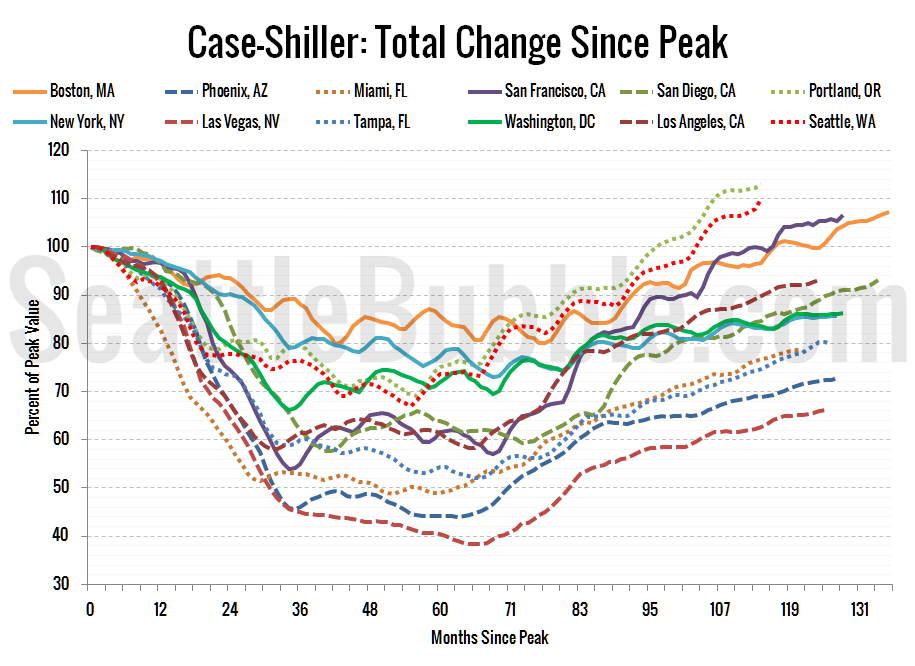

Here’s an update to the peak-decline graph, inspired by a graph created by reader CrystalBall. This chart takes the twelve metro areas whose peak index was greater than 175, and tracks how far they have fallen so far from their peak. The horizontal axis shows the total number of months since each individual city peaked.

In the 115 months since the price peak in Seattle prices are up 10.0 percent.

Lastly, let’s see how Seattle’s current prices compare to the previous bubble inflation and subsequent burst. Note that this chart does not adjust for inflation.

Check back tomorrow for our monthly look at Case-Shiller data for Seattle’s price tiers.

(Home Price Indices, Standard & Poor’s, 2017-04-25)