Now that the big GOP tax plan has passed, let’s have a look at how it may affect the Seattle-area real estate market next year when it goes into effect.

Before we start, I want to be very clear up front: I am neither endorsing nor denouncing the tax plan that just passed. To be honest I don’t personally know anywhere near enough about it to know whether it will be good or bad on the whole. If you’re hoping for that kind of analysis, you should look elsewhere. This analysis is merely a narrow look at how some of the specific changes may affect our local market.

There are two major changes to the tax code that will matter to home buyers and home owners: the doubling of the standard deduction (from $12,700 for a married couple in 2017 to $24,000 in 2018) and the reduction of the mortgage interest deduction cap from $1 million to $750k.

First up let’s look at the doubling of the standard deduction. Here’s an excerpt from a USA Today opinion piece by William E. Brown, president of the National Association of Realtors.

In reality, there’s a homeowner tax hike hiding in plain sight.

The recent tax-reform framework doubles the standard deduction from $6,350 to $12,000 for single filers, and from $12,700 to $24,000 for joint filers.

…the near doubling of the standard deduction means all but the top 5% of American tax filers won’t itemize. That nullifies the incentive effect of the mortgage interest deduction and essentially ends a century-long tradition of encouraging homeownership through the tax code.

I’m sure you will be quite surprised to hear that I find this argument to be complete and utter rubbish. Doubling the standard deduction is not a “homeowner tax hike” by any stretch of the imagination.

To understand what doubling the standard deduction will mean to home owners, let’s look at an example using some relevant local data. Let’s say we’ve got a married couple making $120,000 a year, buying a house at the overall King County median price (across SFH and condos) of $575,000.

We’ll assume that our example couple put 20% down and have an interest rate of 3.90% on their $460,000 mortgage. They would pay an average of $17,100 in mortgage interest per year over the first five years of their mortgage. We’ll also assume that they’re making $4,000 of deductible charitable donations (source), and can deduct $1,400 in state sales tax paid plus $5,800 (1.01% of the home price) in property taxes paid. This gives them a total of $28,300 in itemized deductions.

Under the 2017 tax structure, the standard deduction of $12,700 reduces the couple’s taxable income to $107,300, which puts them in the 25% tax bracket. The standard deduction saves them $3,175 in income tax. If they itemize they can deduct $28,300, which will save them $7,075. That’s a $3,900 tax advantage for the home owner who itemizes.

Under the 2018 tax structure, the standard deduction of $24,000 reduces the couple’s taxable income to $96,000, which puts them in the 22% tax bracket. The standard deduction saves them $5,280 in income tax. They would still have slightly more to deduct if they itemize $28,300, which saves them $6,226. Still a $946 advantage for the itemizing home owner.

To put it another way, it currently makes sense for our hypothetical home owners to itemize if they purchase a home that costs more than about $200,000. Under the new tax structure, that number more than doubles to just under $500,000.

It’s important to note that although the tax savings from itemizing is lower for itemizing the same amount in the 2018 scenario ($6,226 in 2018 vs. $7,075 in 2017) that’s just because the tax rate is lower, which means that the home owner is still paying less of their income in taxes overall.

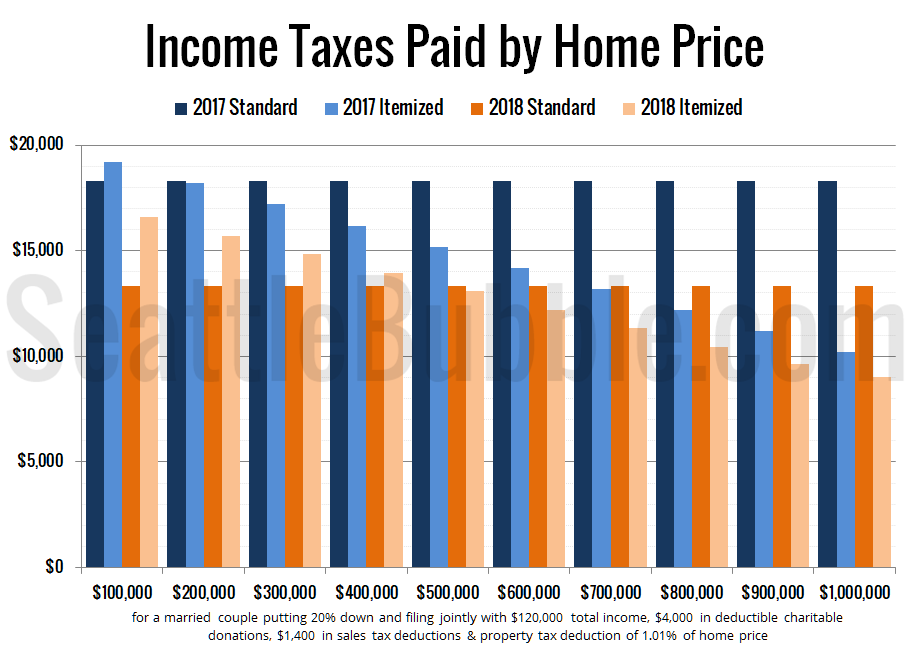

Here’s a graphical look at the total income taxes the hypothetical couple would pay if they itemized the mortgage interest on a variety of home prices. Note: This chart has been updated to reflect the deductions of state sales tax and property tax, which will be capped at $10,000 in 2018).

The change to the standard deduction does slightly reduce the incentive for buying a home by eliminating the benefit for itemizing at most home prices below $500,000, but is it a “tax hike hiding in plain sight”? Not remotely. In fact you can see that at every single home price level above, home owners are paying less in income taxes under the new plan with the higher standard deduction and lower rates.

I highly doubt that there are many people at all whose decision about whether or not to buy a home hinges on whether or not they will be able to save a couple thousand dollars in income tax after paying over $17,000 in mortgage interest. Personally I don’t think this change will have any affect on the housing market at all.

Since this post is getting pretty long, I’m going to split it in two parts. Tomorrow I’ll take a look at the other big change in the tax code: The reduction of the mortgage interest deduction cap from $1 million to $750k.